Pci dss saq d pdf

Attestation of Compliance, SAQ A Instructions for Submission The merchant must complete t his Attestation of Compliance as a declaration of the merchant’s compliance status with the Payment Card Industry Data Security Standard (PCI DSS) Requirements and Security Assessment Procedures. Complete all applicable sections and refer to the submission instructions at “PCI DSS Compliance

SAQ D for Merchants applies to SAQ-eligible merchants not meeting the criteria for any other SAQ type. Examples of merchant environments that would use SAQ D may include but are not limited to: • E-commerce merchants who accept cardholder data on their website.

The SAQ D Policies Packet (Merchants) for Version 3.2 of the PCI DSS standards contains all the necessary PCI policies for compliance with the PCI DSS Self-Assessment Questionnaire D …

The PCI-DSS Self-Assessment Questionnaire or PCI-DSS SAQ is a compliance validation tool that was developed for small merchants who outsource cardholder data storage to third party providers.

Payment Card Industry (PCI) Data Security Standard Self-Assessment Questionnaire D and Attestation of Compliance All other Merchants and all SAQ-Eligible

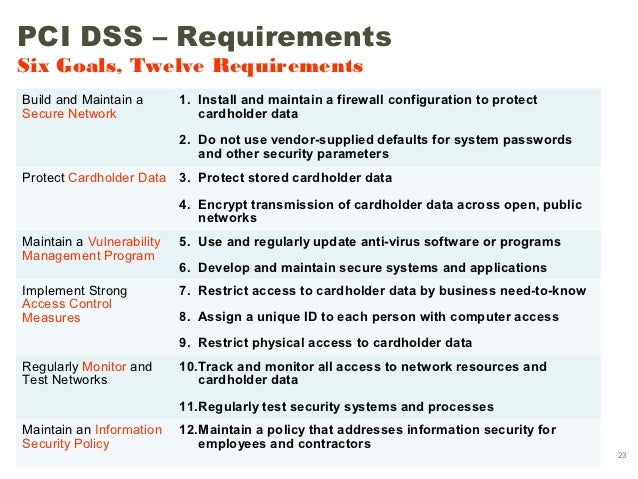

The most complex PCI DSS standard (Self-Assessment Questionnaire D) has 12 requirements (with approximately 63 sub-requirements). The other SAQs are subsets of this “master list” of requirements. The other SAQs are subsets of this “master list” of requirements.

PCI DSS v3.2 SAQ A, (Refer to “Network Segmentation” section of PCI DSS for guidance on network segmentation) Yes No We do not store cardholder data. We process Credit Cards via SSL/TLS connections to Stripe.com API backend services. n/a All connections to web servers use SSL/ TLS and all transactions to stripe.com backend API utilize these connections. VoiceIt does NOT store any

Payment Card Industry (PCI) Data Security Standard Self-Assessment Questionnaire D and Attestation of Compliance for Merchants All other SAQ-Eligible Merchants

Pci self assessment questionnaire saq PDF results Pci dss self-assessment questionnaire ( saq ) Open document Search by title Preview with Google Docs

The PCI Data Security Standard Self Assessment Questionnaire (SAQ) is a validation tool intended to assist merchants and service providers who are permitted by the payment brands to self-evaluate their compliance with the Payment Card Industry Data Security Standard (PCI DSS).

As a merchant who is accepting card transactions your bank will require you to complete the correct PCI DSS SAQ for the API type that you are integrating with. This table is a list of eWAY’s API’s and the relevant SAQ that you must complete.

cardholder data, are redirected to a PCI DSS validated third-party payment processor’. This reflects the PCI SSC’s This reflects the PCI SSC’s assessment of the increased risk associated with SAQ A-EP eligible ecommerce integration methods.

the Vectra PCI DSS Service desk for assistance on 1800558522 or by email to support@vectrapci.com.au When you have setup your IPs/URLs for scanning, click Next.

Fischer International Identity: Facilitating PCI DSS v.3.2 Compliance Through Identity & Access Management 3 SAQ-D Compliance Requirements Facilitated by IAM The table below contains the applicable PCI DSS SAQ-D requirements with which IAM may facilitate

View our PCI DSS Compliance Certificates below: Certificate of Compliance.pdf. Attestation of Compliance (SAQ-D).pdf. Payment Gateways. Payment Gateways are an e-commerce application provided by merchant services to authorize and process credit card payments in a PCI compliant manner. Setting up RMS to connect with a Payment Gateway merchant account provides the ability …

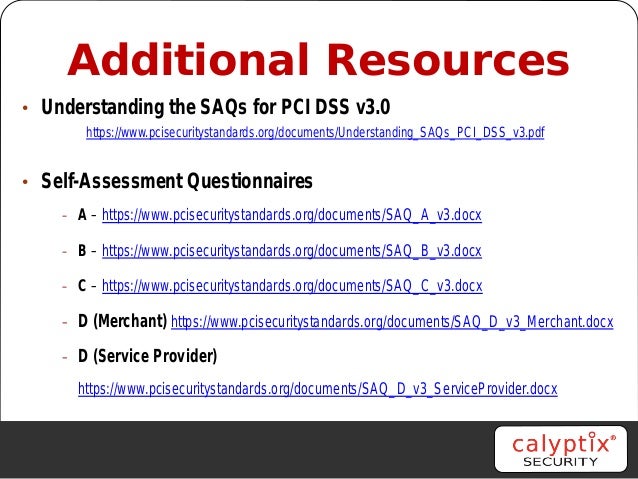

The SAQ Instructions and Guidelines document (note this link takes you to the earlier version) is also being updated for v3.2 to provide additional guidance about the PCI DSS self-assessment process and the different SAQs. It will be available soon in the PCI SSC website document library.

PCI DSS is governed by the PCI Security Standards Council (PCI SSC) and is composed of card schemes such as Visa, MasterCard, American Express, Discover and JCB. The PCI SSC set the rules that define the minimum acceptable security standards and requirement for merchants and service providers. PCI DSS applies to all merchants that store, process or transmit Payment Card Data. …

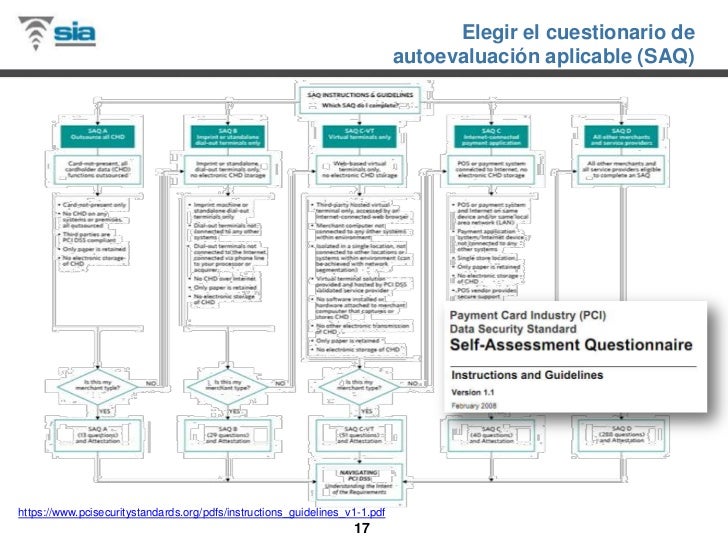

To clarify requirements there is a document called “Navigating PCI DSS – Understanding the Intent of the Requirements” at www.pcisecuritystandards.org web site. If in doubt about how to interpret the questionnaire in regarding to your operation, please contact and consult a QSA. • By answering Questionnaire C, you are confirming that you do not use any Custom Integration features of

PAYMENT CARD INDUSTRY DATA SECURITY STANDARD SELF

PCI SAQ Certification Process PCI Policy Portal

The SAQ is a validation tool intended to assist merchants that are not required to undergo an on-site security assessment, in self-evaluating their compliance with the

Taking a firm stance on the security of partially outsourced e-commerce sites. When the new PCI DSS version 3.0 Self Assessment Questionnaires (SAQs) were released earlier this year, my colleagues and I closely read them to understand the potential impact on self-assessing merchants as well as the merchant service providers ControlScan partners

Pci saq d pdf Pci saq d pdf Pci saq d pdf DOWNLOAD! DIRECT DOWNLOAD! Pci saq d pdf Self-Assessment Questionnaire D and Attestation of Compliance. All other SAQ-Eligible.Payment Card Industry PCI. Self- Assessment Questionnaire D and Attestation of Compliance for. All other SAQ-Eligible.Overview. pci saq d excel The PCI DSS SAQ is a validation tool for merchants and service …

The PCI DSS SAQ is a validation tool for merchants and service providers not required to undergo an on- site data security assessment per the PCI DSS Requirements and …

The PDF is password protected – and the password is encryption. If you’d like some more training then I can recommend my PCI courses at Pluralsight: Payment Card Security, Processing, and the PCI Standards PCI DSS: The Big Picture. So here are the questions. For each one there is only one correct answer. Enjoy. Q1 What information must be included in the network diagram? A: Firewalls

PCIÿ Payment Card Industryÿ 0˙0ü0¿0»0›0å0Œ0˘0£WœnŒ †Œ]æUO−: D R€vß^Š0—0ü0‚0ç0ó 0—0ü0‚0ç0ó 1.2 nŒbà−<f fł

SAQ-A 6.2 – This one inclusion has changed the way we need to look at web servers. PCI DSS version 3.2.1 was introduced earlier this year. Until the end of the year you can still assess against the previous version, but time is soon running out.

pci_dss_saq.pdf – Free download as PDF File (.pdf), Text File (.txt) or read online for free. Scribd is the world's largest social reading and publishing site. Search Search

Based on the results noted in the SAQ D dated (completion date of SAQ), (Service Provider Company Name) asserts the following compliance status (check one): Compliant: All sections of the PCI SAQ are complete, and all questions answered ˝yes ˛, resulting in an

I have read the PCI DSS and I recognize that I must maintain full PCI DSS compliance at all times. No evidence of magnetic stripe (i.e., track) data 2 , CAV2, CVC2, …

D SAQ D for Merchants: All merchants not included in descriptions for the above SAQ types. SAQ D for Service Providers: All service providers defined by a payment brand as eligible to complete a SAQ. * New for PCI DSS v3.0 . The intent of this document is to provide supplemental information. Information provided here Page 2 does not replace or supersede PCI SSC Security Standards or their

SAQ D is the final SAQ and applies to any merchants who do not meet the criteria for other SAQs, as well as all service providers. SAQ D encompasses the full set of over 200 requirements and covers the entirety of the PCI DSS .

Search for jobs related to PCI DSS v3 2 SAQ D Merchant or hire on the world's largest freelancing marketplace with 15m+ jobs. It's free to sign up and bid on jobs.

PCI DSS Self-Assessment Questionnaire B, Version (version of SAQ), was completed according to the instructions therein. All information within the above-referenced SAQ and in this attestation fairly represents the results of my

The SAQ is the PCI DSS documentation of compliance for lower-transaction-volume merchants. There are five There are five different versions of the SAQ, depending on the payment methods you use, whether you store cardholder data, and

Although this is an incremental PCI DSS release, it’s important to understand how the 3.2 SAQs differ from those issued with PCI DSS v3.1. First, the good news. There are no new SAQs and with this release, the eligibility criteria for each SAQ is essentially the same:

PCI DSS Self -Assessment Questionnaire D, Version (version of SAQ), was completed according to the instructions therein. All information within the above -referenced SAQ and in this attestation fairly represents the results of my

PDQ Guide for the PCI Data Security Standard Self-Assessment Questionnaire C (Version 1.1) • PDQ has created an Answer Guide for the Payment Card Industry (PCI) Data Security Standard Self-Assessment Questionnaire C to help wash operators complete questionnaires. Part of the Access Customer Management System (CMS) operator manual is the PABP Implementation Guide, which …

ReymannGroup, Inc. © WatchGuard Company Confidential – PCI DSS SAQ Tool PCI DSS Self Assessment Questionnaire (SAQ) Tool

The SAQ is a validation tool intended to assist merchants that are not required to undergo an on-site security assessment, in self-evaluating their compliance with

SAQ D: “applies to SAQ-eligible merchants not meeting the criteria for any other SAQ type” Options for any project requiring unachievable levels of PCI DSS compliance . 1. Outsource processing, storage and transmission of credit card data to a PCI DSS compliant company in such a way that LSE compliance can be achieved under levels defined in 3.2. 2. Change the scope of the project so that LSE

PCI Certifications & Compliance RMS

and directly from a PCI DSS validated third-party service provider(s). If you are doing anything other than the processes listed above, you may not complete SAQ A. Please email UTIAsecurity@tennessee.edu if you think you need to change SAQ types.

Getting Started with the PCI Compliance Service 7 the component report in PDF, for the network or questionnaire, and saves it in your account so you can download it as needed.

Request to Cancel Merchant Account/Return Equipment (pdf) PCI DSS Forms These Self-Assessment Questionnaires (SAQ) are validation tools intended to help merchants self-evaluate their compliance with PCI DSS.

Data Security Standard Self-Assessment Questionnaire D PCI DSS Version SAQ Revision Description October 2008 1.2 To align content with new PCI DSS v1.2 and to implement minor changes noted since original v1.1. October 2010 2.0 To align content with new PCI DSS v2.0 requirements and testing procedures. February 2014 3.0 To align content with PCI DSS v3.0 requirements and testing …

•PCI DSS 101 •Chip Cards (EMV) PCI Compliance • Focused Solely on •SAQ D for service providers •MICROS Simphony/WK5A registers •Partnered with FreedomPay for P2PE •SAQ A 21. FreedomPay Setup 22. Congratulations! Complying with the PCI DSS is NOT a project. It is an evolving, continuous process that has no end.? 23. Verizon Data Breach Investigations Report Each year, the

APPLICABILITY OF PCI DATA SECURITY STANDARD (PCI DSS) TO CARD CAPTURE METHODS NC Office of the State Controller General Requirements for Merchants – canada paper tax return form drop off toronto west Just a quick reminder that the PCI Security Standards Council (PCI SSC) has published a minor revision to the PCI DSS. The PCI DSS has now been updated from version 3.2 to version 3.2.1.

PCI DSS Self-Assessment Questionnaire C, Version (SAQ version #), was completed according to the instructions therein. All information within the above-referenced SAQ and in this attestation fairly represents the results of my

Based on the results noted in the SAQ D dated (completion date of SAQ), (Service Provider Company Name) asserts the following compliance status (check one): En cumplimiento: All sections of the PCI SAQ are complete, and all questions answered ˝yes ˛, resulting in

Search for jobs related to Pci saq a or hire on the world’s largest freelancing marketplace with 15m+ jobs. It’s free to sign up and bid on jobs.

Section 3: Validation and Attestation Details Part 3. PCI DSS Validation This AOC is based on results noted in SAQ D (Section 2), dated 2017-12-13 15:34 PM.

Note: For this SAQ, PCI DSS Requirements that address the protection of computer systems (for example, Requirements 2 and 8) apply to e-commerce merchants that redirect customers from their website to a third party for payment processing, an d specifically to the merchant webserver upon which

PCI DSS Requirements and Security Assessment Procedures Documents for your PCI DSS Self-Assessment SAQ Instructions and Guidelines SAO FAQs Information Supplements* and general FAQs Self-Assessment Questionnaires A through D, and P2PE PCI DSS Glossary of Terms, Abbreviations, and Acronyms SAQ Attestations of Compliance . 0 o a (1) O O o x: o E 8 c: e o c 8 v 0-2 — c O o c …

Section 3: Validation and Attestation Details Part 3. PCI DSS Validation This AOC is based on results noted in SAQ D (Section 2), dated 2017-07-19 12:13 PM.

PCI SAQ Certification Process in 10 Easy Steps Please review the following steps regarding the PCI DSS compliance certification process for the Self-Assessment Questionnaires (SAQ) for merchants and service providers: 1. Determine Appropriate Merchant and Service Provider Level. Before you begin down the road of the PCI DSS compliance

processing), and D. SAQ A-EP is a new addition to PCI compliance, and lies between A (easy) and D (full PCI standard) in complexity. Take a look at the slide to compare eligibility and requirements of each SAQ. SecurityMetrics Ecommerce Guide to PCI DSS 3.0 Before we dive into the ecommerce processing methods, we need to first understand the entities (players) and activities (steps) that …

The PCI Security Standards Council is an open global forum that is responsible for the development, management, education, and awareness of the PCI Data Security Standard (PCI-DSS) and other standards that increase payment data security. Founded in 2006 by the major payment card brands American Express, Discover, JCB International, MasterCard and Visa Inc., the Council has more …

Section 2 – PCI DSS Self-Assessment Questionnaire (SAQ D) Section 3 (Parts 3 & 4 of the AOC) – Validation and Attestation Details and Action Plan for Non- Compliant Requirements (if applicable)

PCI DSS v3.2 SAQ What has changed

The Payment Card Industry Data Security Standards (PCIDSS) is a set of comprehensive requirements for enhancing payment account data security and forms industry best practice for any entity that stores, processes and/or transmits cardholder data.

PCI SAQ C-VT Guide Page 3 of 25 Introduction This document has been created to help all University of Tennessee Institute of Agriculture (Institute) merchants completing Payment Card Industry Data Security Standard (PCI DSS) Self-

Payment Card Industry (PCI) Data Security Standard Self-Assessment Questionnaire D and Attestation of Compliance for Service Providers SAQ-Eligible Service Providers

Understanding the SAQs for PCI DSS v3 LeumiCard

Ecommerce Guide to PCI DSS 3 Security

Getting Started with the PCI Compliance Service Qualys

PCI DSS Ingenico ePayments Developers

PDQ Guidelines to PCI Self-Assessment Questionnaire C

View SAQ D (PDF) pcisecuritystandards.org

PCI DSS 3.2 SAQ updates PCI Security Standards

– Norma de seguridad de datos de la Industria de tarjetas de

An In-Depth Look at the PCI 3.2 SAQs PCI Compliance Guide

PCI DSS Self Assessment Questionnaire (SAQ) Tool

PCI DSS Forms & Procedures UBC Finance

PCI SAQ HackerGuardian PCI DSS Self Assessment Questionnaire

VoiceIt’s Stripe SAQ-A Compliance.

SAQ-A 6.2 – This one inclusion has changed the way we need to look at web servers. PCI DSS version 3.2.1 was introduced earlier this year. Until the end of the year you can still assess against the previous version, but time is soon running out.

The SAQ is the PCI DSS documentation of compliance for lower-transaction-volume merchants. There are five There are five different versions of the SAQ, depending on the payment methods you use, whether you store cardholder data, and

The Payment Card Industry Data Security Standards (PCIDSS) is a set of comprehensive requirements for enhancing payment account data security and forms industry best practice for any entity that stores, processes and/or transmits cardholder data.

I have read the PCI DSS and I recognize that I must maintain full PCI DSS compliance at all times. No evidence of magnetic stripe (i.e., track) data 2 , CAV2, CVC2, …

SAQ D is the final SAQ and applies to any merchants who do not meet the criteria for other SAQs, as well as all service providers. SAQ D encompasses the full set of over 200 requirements and covers the entirety of the PCI DSS .

Taking a firm stance on the security of partially outsourced e-commerce sites. When the new PCI DSS version 3.0 Self Assessment Questionnaires (SAQs) were released earlier this year, my colleagues and I closely read them to understand the potential impact on self-assessing merchants as well as the merchant service providers ControlScan partners

The PCI Data Security Standard Self Assessment Questionnaire (SAQ) is a validation tool intended to assist merchants and service providers who are permitted by the payment brands to self-evaluate their compliance with the Payment Card Industry Data Security Standard (PCI DSS).

Based on the results noted in the SAQ D dated (completion date of SAQ), (Service Provider Company Name) asserts the following compliance status (check one): En cumplimiento: All sections of the PCI SAQ are complete, and all questions answered ˝yes ˛, resulting in

The PCI DSS SAQ is a validation tool for merchants and service providers not required to undergo an on- site data security assessment per the PCI DSS Requirements and …

Search for jobs related to Pci saq a or hire on the world’s largest freelancing marketplace with 15m jobs. It’s free to sign up and bid on jobs.

Attestation of Compliance, SAQ A Instructions for Submission The merchant must complete t his Attestation of Compliance as a declaration of the merchant’s compliance status with the Payment Card Industry Data Security Standard (PCI DSS) Requirements and Security Assessment Procedures. Complete all applicable sections and refer to the submission instructions at “PCI DSS Compliance

SAQ D for Merchants applies to SAQ-eligible merchants not meeting the criteria for any other SAQ type. Examples of merchant environments that would use SAQ D may include but are not limited to: • E-commerce merchants who accept cardholder data on their website.

Section 3: Validation and Attestation Details Part 3. PCI DSS Validation This AOC is based on results noted in SAQ D (Section 2), dated 2017-07-19 12:13 PM.

PCI DSS Requirements and Security Assessment Procedures Documents for your PCI DSS Self-Assessment SAQ Instructions and Guidelines SAO FAQs Information Supplements* and general FAQs Self-Assessment Questionnaires A through D, and P2PE PCI DSS Glossary of Terms, Abbreviations, and Acronyms SAQ Attestations of Compliance . 0 o a (1) O O o x: o E 8 c: e o c 8 v 0-2 — c O o c …

PCI DSS eWAY Singapore

PDQ Guidelines to PCI Self-Assessment Questionnaire C

The PDF is password protected – and the password is encryption. If you’d like some more training then I can recommend my PCI courses at Pluralsight: Payment Card Security, Processing, and the PCI Standards PCI DSS: The Big Picture. So here are the questions. For each one there is only one correct answer. Enjoy. Q1 What information must be included in the network diagram? A: Firewalls

Taking a firm stance on the security of partially outsourced e-commerce sites. When the new PCI DSS version 3.0 Self Assessment Questionnaires (SAQs) were released earlier this year, my colleagues and I closely read them to understand the potential impact on self-assessing merchants as well as the merchant service providers ControlScan partners

The PCI DSS SAQ is a validation tool for merchants and service providers not required to undergo an on- site data security assessment per the PCI DSS Requirements and …

the Vectra PCI DSS Service desk for assistance on 1800558522 or by email to support@vectrapci.com.au When you have setup your IPs/URLs for scanning, click Next.

PCI DSS is governed by the PCI Security Standards Council (PCI SSC) and is composed of card schemes such as Visa, MasterCard, American Express, Discover and JCB. The PCI SSC set the rules that define the minimum acceptable security standards and requirement for merchants and service providers. PCI DSS applies to all merchants that store, process or transmit Payment Card Data. …

PCI SAQ C-VT Guide Page 3 of 25 Introduction This document has been created to help all University of Tennessee Institute of Agriculture (Institute) merchants completing Payment Card Industry Data Security Standard (PCI DSS) Self-

SAQ D for Merchants applies to SAQ-eligible merchants not meeting the criteria for any other SAQ type. Examples of merchant environments that would use SAQ D may include but are not limited to: • E-commerce merchants who accept cardholder data on their website.

The PCI-DSS Self-Assessment Questionnaire or PCI-DSS SAQ is a compliance validation tool that was developed for small merchants who outsource cardholder data storage to third party providers.

Although this is an incremental PCI DSS release, it’s important to understand how the 3.2 SAQs differ from those issued with PCI DSS v3.1. First, the good news. There are no new SAQs and with this release, the eligibility criteria for each SAQ is essentially the same:

PDQ Guide for the PCI Data Security Standard Self-Assessment Questionnaire C (Version 1.1) • PDQ has created an Answer Guide for the Payment Card Industry (PCI) Data Security Standard Self-Assessment Questionnaire C to help wash operators complete questionnaires. Part of the Access Customer Management System (CMS) operator manual is the PABP Implementation Guide, which …

Ecommerce Guide to PCI DSS 3 Security

PDQ Guidelines to PCI Self-Assessment Questionnaire C

Getting Started with the PCI Compliance Service 7 the component report in PDF, for the network or questionnaire, and saves it in your account so you can download it as needed.

The PCI Security Standards Council is an open global forum that is responsible for the development, management, education, and awareness of the PCI Data Security Standard (PCI-DSS) and other standards that increase payment data security. Founded in 2006 by the major payment card brands American Express, Discover, JCB International, MasterCard and Visa Inc., the Council has more …

Pci saq d pdf Pci saq d pdf Pci saq d pdf DOWNLOAD! DIRECT DOWNLOAD! Pci saq d pdf Self-Assessment Questionnaire D and Attestation of Compliance. All other SAQ-Eligible.Payment Card Industry PCI. Self- Assessment Questionnaire D and Attestation of Compliance for. All other SAQ-Eligible.Overview. pci saq d excel The PCI DSS SAQ is a validation tool for merchants and service …

Although this is an incremental PCI DSS release, it’s important to understand how the 3.2 SAQs differ from those issued with PCI DSS v3.1. First, the good news. There are no new SAQs and with this release, the eligibility criteria for each SAQ is essentially the same:

•PCI DSS 101 •Chip Cards (EMV) PCI Compliance • Focused Solely on •SAQ D for service providers •MICROS Simphony/WK5A registers •Partnered with FreedomPay for P2PE •SAQ A 21. FreedomPay Setup 22. Congratulations! Complying with the PCI DSS is NOT a project. It is an evolving, continuous process that has no end.? 23. Verizon Data Breach Investigations Report Each year, the

Taking a firm stance on the security of partially outsourced e-commerce sites. When the new PCI DSS version 3.0 Self Assessment Questionnaires (SAQs) were released earlier this year, my colleagues and I closely read them to understand the potential impact on self-assessing merchants as well as the merchant service providers ControlScan partners

The SAQ is a validation tool intended to assist merchants that are not required to undergo an on-site security assessment, in self-evaluating their compliance with the

Search for jobs related to PCI DSS v3 2 SAQ D Merchant or hire on the world’s largest freelancing marketplace with 15m jobs. It’s free to sign up and bid on jobs.

PCI DSS is governed by the PCI Security Standards Council (PCI SSC) and is composed of card schemes such as Visa, MasterCard, American Express, Discover and JCB. The PCI SSC set the rules that define the minimum acceptable security standards and requirement for merchants and service providers. PCI DSS applies to all merchants that store, process or transmit Payment Card Data. …

PDQ Guidelines to PCI Self-Assessment Questionnaire C

Instructions SAQ-D for Merchants Using Shift4’s True P2PE

Data Security Standard Self-Assessment Questionnaire D PCI DSS Version SAQ Revision Description October 2008 1.2 To align content with new PCI DSS v1.2 and to implement minor changes noted since original v1.1. October 2010 2.0 To align content with new PCI DSS v2.0 requirements and testing procedures. February 2014 3.0 To align content with PCI DSS v3.0 requirements and testing …

ReymannGroup, Inc. © WatchGuard Company Confidential – PCI DSS SAQ Tool PCI DSS Self Assessment Questionnaire (SAQ) Tool

Payment Card Industry (PCI) Data Security Standard Self-Assessment Questionnaire D and Attestation of Compliance All other Merchants and all SAQ-Eligible

The PCI DSS SAQ is a validation tool for merchants and service providers not required to undergo an on- site data security assessment per the PCI DSS Requirements and …

Attestation of Compliance, SAQ A Instructions for Submission The merchant must complete t his Attestation of Compliance as a declaration of the merchant’s compliance status with the Payment Card Industry Data Security Standard (PCI DSS) Requirements and Security Assessment Procedures. Complete all applicable sections and refer to the submission instructions at “PCI DSS Compliance

Pci self assessment questionnaire saq PDF results Pci dss self-assessment questionnaire ( saq ) Open document Search by title Preview with Google Docs

processing), and D. SAQ A-EP is a new addition to PCI compliance, and lies between A (easy) and D (full PCI standard) in complexity. Take a look at the slide to compare eligibility and requirements of each SAQ. SecurityMetrics Ecommerce Guide to PCI DSS 3.0 Before we dive into the ecommerce processing methods, we need to first understand the entities (players) and activities (steps) that …

pci_dss_saq.pdf – Free download as PDF File (.pdf), Text File (.txt) or read online for free. Scribd is the world’s largest social reading and publishing site. Search Search

Getting Started with the PCI Compliance Service 7 the component report in PDF, for the network or questionnaire, and saves it in your account so you can download it as needed.

PCI SAQ Certification Process in 10 Easy Steps Please review the following steps regarding the PCI DSS compliance certification process for the Self-Assessment Questionnaires (SAQ) for merchants and service providers: 1. Determine Appropriate Merchant and Service Provider Level. Before you begin down the road of the PCI DSS compliance

The most complex PCI DSS standard (Self-Assessment Questionnaire D) has 12 requirements (with approximately 63 sub-requirements). The other SAQs are subsets of this “master list” of requirements. The other SAQs are subsets of this “master list” of requirements.

The PCI Security Standards Council is an open global forum that is responsible for the development, management, education, and awareness of the PCI Data Security Standard (PCI-DSS) and other standards that increase payment data security. Founded in 2006 by the major payment card brands American Express, Discover, JCB International, MasterCard and Visa Inc., the Council has more …

Note: For this SAQ, PCI DSS Requirements that address the protection of computer systems (for example, Requirements 2 and 8) apply to e-commerce merchants that redirect customers from their website to a third party for payment processing, an d specifically to the merchant webserver upon which

PCI DSS v3.2 SAQ A, (Refer to “Network Segmentation” section of PCI DSS for guidance on network segmentation) Yes No We do not store cardholder data. We process Credit Cards via SSL/TLS connections to Stripe.com API backend services. n/a All connections to web servers use SSL/ TLS and all transactions to stripe.com backend API utilize these connections. VoiceIt does NOT store any

PCI_DSS_SAQ_DSP_v3-1_Report.pdf Payment Card Industry

PCI DSS Self Assessment Questionnaire (SAQ) Tool

Section 3: Validation and Attestation Details Part 3. PCI DSS Validation This AOC is based on results noted in SAQ D (Section 2), dated 2017-12-13 15:34 PM.

As a merchant who is accepting card transactions your bank will require you to complete the correct PCI DSS SAQ for the API type that you are integrating with. This table is a list of eWAY’s API’s and the relevant SAQ that you must complete.

PCI DSS Self-Assessment Questionnaire C, Version (SAQ version #), was completed according to the instructions therein. All information within the above-referenced SAQ and in this attestation fairly represents the results of my

PCIÿ Payment Card Industryÿ 0˙0ü0¿0»0›0å0Œ0˘0£WœnŒ †Œ]æUO−: D R€vß^Š0—0ü0‚0ç0ó 0—0ü0‚0ç0ó 1.2 nŒbà−<f fł

and directly from a PCI DSS validated third-party service provider(s). If you are doing anything other than the processes listed above, you may not complete SAQ A. Please email UTIAsecurity@tennessee.edu if you think you need to change SAQ types.

The PCI-DSS Self-Assessment Questionnaire or PCI-DSS SAQ is a compliance validation tool that was developed for small merchants who outsource cardholder data storage to third party providers.

SAQ D is the final SAQ and applies to any merchants who do not meet the criteria for other SAQs, as well as all service providers. SAQ D encompasses the full set of over 200 requirements and covers the entirety of the PCI DSS .

Section 2 – PCI DSS Self-Assessment Questionnaire (SAQ D) Section 3 (Parts 3 & 4 of the AOC) – Validation and Attestation Details and Action Plan for Non- Compliant Requirements (if applicable)

SAQ D for Merchants applies to SAQ-eligible merchants not meeting the criteria for any other SAQ type. Examples of merchant environments that would use SAQ D may include but are not limited to: • E-commerce merchants who accept cardholder data on their website.

Search for jobs related to Pci saq a or hire on the world's largest freelancing marketplace with 15m jobs. It's free to sign up and bid on jobs.

Taking a firm stance on the security of partially outsourced e-commerce sites. When the new PCI DSS version 3.0 Self Assessment Questionnaires (SAQs) were released earlier this year, my colleagues and I closely read them to understand the potential impact on self-assessing merchants as well as the merchant service providers ControlScan partners

The PCI Data Security Standard Self Assessment Questionnaire (SAQ) is a validation tool intended to assist merchants and service providers who are permitted by the payment brands to self-evaluate their compliance with the Payment Card Industry Data Security Standard (PCI DSS).

PCI SAQ Certification Process in 10 Easy Steps Please review the following steps regarding the PCI DSS compliance certification process for the Self-Assessment Questionnaires (SAQ) for merchants and service providers: 1. Determine Appropriate Merchant and Service Provider Level. Before you begin down the road of the PCI DSS compliance

The SAQ is the PCI DSS documentation of compliance for lower-transaction-volume merchants. There are five There are five different versions of the SAQ, depending on the payment methods you use, whether you store cardholder data, and

The most complex PCI DSS standard (Self-Assessment Questionnaire D) has 12 requirements (with approximately 63 sub-requirements). The other SAQs are subsets of this “master list” of requirements. The other SAQs are subsets of this “master list” of requirements.

PCI-DSS Self-Assessment Questionnaire Definitions and

PCI DSS Forms & Procedures UBC Finance

The SAQ is a validation tool intended to assist merchants that are not required to undergo an on-site security assessment, in self-evaluating their compliance with

The PDF is password protected – and the password is encryption. If you’d like some more training then I can recommend my PCI courses at Pluralsight: Payment Card Security, Processing, and the PCI Standards PCI DSS: The Big Picture. So here are the questions. For each one there is only one correct answer. Enjoy. Q1 What information must be included in the network diagram? A: Firewalls

SAQ D is the final SAQ and applies to any merchants who do not meet the criteria for other SAQs, as well as all service providers. SAQ D encompasses the full set of over 200 requirements and covers the entirety of the PCI DSS .

Based on the results noted in the SAQ D dated (completion date of SAQ), (Service Provider Company Name) asserts the following compliance status (check one): En cumplimiento: All sections of the PCI SAQ are complete, and all questions answered ˝yes ˛, resulting in

PCI DSS Self-Assessment Questionnaire C, Version (SAQ version #), was completed according to the instructions therein. All information within the above-referenced SAQ and in this attestation fairly represents the results of my

As a merchant who is accepting card transactions your bank will require you to complete the correct PCI DSS SAQ for the API type that you are integrating with. This table is a list of eWAY’s API’s and the relevant SAQ that you must complete.

pci_dss_saq.pdf – Free download as PDF File (.pdf), Text File (.txt) or read online for free. Scribd is the world’s largest social reading and publishing site. Search Search

PCI SAQ C-VT Guide Page 3 of 25 Introduction This document has been created to help all University of Tennessee Institute of Agriculture (Institute) merchants completing Payment Card Industry Data Security Standard (PCI DSS) Self-

SAQ-A 6.2 – This one inclusion has changed the way we need to look at web servers. PCI DSS version 3.2.1 was introduced earlier this year. Until the end of the year you can still assess against the previous version, but time is soon running out.

The PCI Data Security Standard Self Assessment Questionnaire (SAQ) is a validation tool intended to assist merchants and service providers who are permitted by the payment brands to self-evaluate their compliance with the Payment Card Industry Data Security Standard (PCI DSS).

PCI SAQ Certification Process PCI Policy Portal

PCI_DSS_SAQ_DSP_v3-1_Report.pdf Payment Card Industry

The PCI Data Security Standard Self Assessment Questionnaire (SAQ) is a validation tool intended to assist merchants and service providers who are permitted by the payment brands to self-evaluate their compliance with the Payment Card Industry Data Security Standard (PCI DSS).

ReymannGroup, Inc. © WatchGuard Company Confidential – PCI DSS SAQ Tool PCI DSS Self Assessment Questionnaire (SAQ) Tool

pci_dss_saq.pdf – Free download as PDF File (.pdf), Text File (.txt) or read online for free. Scribd is the world’s largest social reading and publishing site. Search Search

PCIÿ Payment Card Industryÿ 0˙0ü0¿0»0›0å0Œ0˘0£WœnŒ †Œ]æUO−: D R€vß^Š0—0ü0‚0ç0ó 0—0ü0‚0ç0ó 1.2 nŒbà−<f fł

PCI DSS eWAY New Zealand

PCI Compliance c.ymcdn.com

SAQ D for Merchants applies to SAQ-eligible merchants not meeting the criteria for any other SAQ type. Examples of merchant environments that would use SAQ D may include but are not limited to: • E-commerce merchants who accept cardholder data on their website.

and directly from a PCI DSS validated third-party service provider(s). If you are doing anything other than the processes listed above, you may not complete SAQ A. Please email UTIAsecurity@tennessee.edu if you think you need to change SAQ types.

processing), and D. SAQ A-EP is a new addition to PCI compliance, and lies between A (easy) and D (full PCI standard) in complexity. Take a look at the slide to compare eligibility and requirements of each SAQ. SecurityMetrics Ecommerce Guide to PCI DSS 3.0 Before we dive into the ecommerce processing methods, we need to first understand the entities (players) and activities (steps) that …

PCI DSS v3.2 SAQ A, (Refer to “Network Segmentation” section of PCI DSS for guidance on network segmentation) Yes No We do not store cardholder data. We process Credit Cards via SSL/TLS connections to Stripe.com API backend services. n/a All connections to web servers use SSL/ TLS and all transactions to stripe.com backend API utilize these connections. VoiceIt does NOT store any

I have read the PCI DSS and I recognize that I must maintain full PCI DSS compliance at all times. No evidence of magnetic stripe (i.e., track) data 2 , CAV2, CVC2, …

Taking a firm stance on the security of partially outsourced e-commerce sites. When the new PCI DSS version 3.0 Self Assessment Questionnaires (SAQs) were released earlier this year, my colleagues and I closely read them to understand the potential impact on self-assessing merchants as well as the merchant service providers ControlScan partners

Section 3: Validation and Attestation Details Part 3. PCI DSS Validation This AOC is based on results noted in SAQ D (Section 2), dated 2017-07-19 12:13 PM.

Getting Started with the PCI Compliance Service 7 the component report in PDF, for the network or questionnaire, and saves it in your account so you can download it as needed.

The SAQ is a validation tool intended to assist merchants that are not required to undergo an on-site security assessment, in self-evaluating their compliance with

Attestation of Compliance, SAQ A Instructions for Submission The merchant must complete t his Attestation of Compliance as a declaration of the merchant’s compliance status with the Payment Card Industry Data Security Standard (PCI DSS) Requirements and Security Assessment Procedures. Complete all applicable sections and refer to the submission instructions at “PCI DSS Compliance

SAQ-A 6.2 – This one inclusion has changed the way we need to look at web servers. PCI DSS version 3.2.1 was introduced earlier this year. Until the end of the year you can still assess against the previous version, but time is soon running out.

Fischer International Identity: Facilitating PCI DSS v.3.2 Compliance Through Identity & Access Management 3 SAQ-D Compliance Requirements Facilitated by IAM The table below contains the applicable PCI DSS SAQ-D requirements with which IAM may facilitate

The PCI Data Security Standard Self Assessment Questionnaire (SAQ) is a validation tool intended to assist merchants and service providers who are permitted by the payment brands to self-evaluate their compliance with the Payment Card Industry Data Security Standard (PCI DSS).

PCIÿ Payment Card Industryÿ 0˙0ü0¿0»0›0å0Œ0˘0£WœnŒ †Œ]æUO−: D R€vß^Š0—0ü0‚0ç0ó 0—0ü0‚0ç0ó 1.2 nŒbà−<f fł

APPLICABILITY OF PCI DATA SECURITY STANDARD (PCI DSS) TO CARD CAPTURE METHODS NC Office of the State Controller General Requirements for Merchants

SAQ-InstrGuidelines-v3 2 UBC Finance

PCI DSS eWAY New Zealand

the Vectra PCI DSS Service desk for assistance on 1800558522 or by email to support@vectrapci.com.au When you have setup your IPs/URLs for scanning, click Next.

Search for jobs related to Pci saq a or hire on the world’s largest freelancing marketplace with 15m jobs. It’s free to sign up and bid on jobs.

SAQ D for Merchants applies to SAQ-eligible merchants not meeting the criteria for any other SAQ type. Examples of merchant environments that would use SAQ D may include but are not limited to: • E-commerce merchants who accept cardholder data on their website.

The PCI Data Security Standard Self Assessment Questionnaire (SAQ) is a validation tool intended to assist merchants and service providers who are permitted by the payment brands to self-evaluate their compliance with the Payment Card Industry Data Security Standard (PCI DSS).

PCIÿ Payment Card Industryÿ 0˙0ü0¿0»0›0å0Œ0˘0£WœnŒ †Œ]æUO−: D R€vß^Š0—0ü0‚0ç0ó 0—0ü0‚0ç0ó 1.2 nŒbà−<f fł

The SAQ is the PCI DSS documentation of compliance for lower-transaction-volume merchants. There are five There are five different versions of the SAQ, depending on the payment methods you use, whether you store cardholder data, and

D SAQ D for Merchants: All merchants not included in descriptions for the above SAQ types. SAQ D for Service Providers: All service providers defined by a payment brand as eligible to complete a SAQ. * New for PCI DSS v3.0 . The intent of this document is to provide supplemental information. Information provided here Page 2 does not replace or supersede PCI SSC Security Standards or their

PCI DSS Forms & Procedures UBC Finance

PCI DSS PCI-Guy.com

Section 2 – PCI DSS Self-Assessment Questionnaire (SAQ D) Section 3 (Parts 3 & 4 of the AOC) – Validation and Attestation Details and Action Plan for Non- Compliant Requirements (if applicable)

As a merchant who is accepting card transactions your bank will require you to complete the correct PCI DSS SAQ for the API type that you are integrating with. This table is a list of eWAY’s API’s and the relevant SAQ that you must complete.

Taking a firm stance on the security of partially outsourced e-commerce sites. When the new PCI DSS version 3.0 Self Assessment Questionnaires (SAQs) were released earlier this year, my colleagues and I closely read them to understand the potential impact on self-assessing merchants as well as the merchant service providers ControlScan partners

PCIÿ Payment Card Industryÿ 0˙0ü0¿0»0›0å0Œ0˘0£WœnŒ †Œ]æUO−: D R€vß^Š0—0ü0‚0ç0ó 0—0ü0‚0ç0ó 1.2 nŒbà−<f fł

ReymannGroup, Inc. © WatchGuard Company Confidential – PCI DSS SAQ Tool PCI DSS Self Assessment Questionnaire (SAQ) Tool

The Payment Card Industry Data Security Standards (PCIDSS) is a set of comprehensive requirements for enhancing payment account data security and forms industry best practice for any entity that stores, processes and/or transmits cardholder data.

PCI DSS v3.2 SAQ A, (Refer to “Network Segmentation” section of PCI DSS for guidance on network segmentation) Yes No We do not store cardholder data. We process Credit Cards via SSL/TLS connections to Stripe.com API backend services. n/a All connections to web servers use SSL/ TLS and all transactions to stripe.com backend API utilize these connections. VoiceIt does NOT store any

Understanding the SAQs for PCI DSS v3 LeumiCard

Guidelines for Securing Cardholder Data for your eCommerce

SAQ-A 6.2 – This one inclusion has changed the way we need to look at web servers. PCI DSS version 3.2.1 was introduced earlier this year. Until the end of the year you can still assess against the previous version, but time is soon running out.

Note: For this SAQ, PCI DSS Requirements that address the protection of computer systems (for example, Requirements 2 and 8) apply to e-commerce merchants that redirect customers from their website to a third party for payment processing, an d specifically to the merchant webserver upon which

PCI DSS Requirements and Security Assessment Procedures Documents for your PCI DSS Self-Assessment SAQ Instructions and Guidelines SAO FAQs Information Supplements* and general FAQs Self-Assessment Questionnaires A through D, and P2PE PCI DSS Glossary of Terms, Abbreviations, and Acronyms SAQ Attestations of Compliance . 0 o a (1) O O o x: o E 8 c: e o c 8 v 0-2 — c O o c …

PCI DSS Self-Assessment Questionnaire B, Version (version of SAQ), was completed according to the instructions therein. All information within the above-referenced SAQ and in this attestation fairly represents the results of my

The PCI DSS SAQ is a validation tool for merchants and service providers not required to undergo an on- site data security assessment per the PCI DSS Requirements and …

Based on the results noted in the SAQ D dated (completion date of SAQ), (Service Provider Company Name) asserts the following compliance status (check one): En cumplimiento: All sections of the PCI SAQ are complete, and all questions answered ˝yes ˛, resulting in

SAQ D: “applies to SAQ-eligible merchants not meeting the criteria for any other SAQ type” Options for any project requiring unachievable levels of PCI DSS compliance . 1. Outsource processing, storage and transmission of credit card data to a PCI DSS compliant company in such a way that LSE compliance can be achieved under levels defined in 3.2. 2. Change the scope of the project so that LSE

ReymannGroup, Inc. © WatchGuard Company Confidential – PCI DSS SAQ Tool PCI DSS Self Assessment Questionnaire (SAQ) Tool

Although this is an incremental PCI DSS release, it’s important to understand how the 3.2 SAQs differ from those issued with PCI DSS v3.1. First, the good news. There are no new SAQs and with this release, the eligibility criteria for each SAQ is essentially the same:

The PDF is password protected – and the password is encryption. If you’d like some more training then I can recommend my PCI courses at Pluralsight: Payment Card Security, Processing, and the PCI Standards PCI DSS: The Big Picture. So here are the questions. For each one there is only one correct answer. Enjoy. Q1 What information must be included in the network diagram? A: Firewalls

Pci self assessment questionnaire saq PDF results Pci dss self-assessment questionnaire ( saq ) Open document Search by title Preview with Google Docs

processing), and D. SAQ A-EP is a new addition to PCI compliance, and lies between A (easy) and D (full PCI standard) in complexity. Take a look at the slide to compare eligibility and requirements of each SAQ. SecurityMetrics Ecommerce Guide to PCI DSS 3.0 Before we dive into the ecommerce processing methods, we need to first understand the entities (players) and activities (steps) that …

The most complex PCI DSS standard (Self-Assessment Questionnaire D) has 12 requirements (with approximately 63 sub-requirements). The other SAQs are subsets of this “master list” of requirements. The other SAQs are subsets of this “master list” of requirements.

PCI_DSS_SAQ_DSP_v3-1_Report.pdf Payment Card Industry

View SAQ D (PDF) PCI Security Standards

Request to Cancel Merchant Account/Return Equipment (pdf) PCI DSS Forms These Self-Assessment Questionnaires (SAQ) are validation tools intended to help merchants self-evaluate their compliance with PCI DSS.

and directly from a PCI DSS validated third-party service provider(s). If you are doing anything other than the processes listed above, you may not complete SAQ A. Please email UTIAsecurity@tennessee.edu if you think you need to change SAQ types.

SAQ D: “applies to SAQ-eligible merchants not meeting the criteria for any other SAQ type” Options for any project requiring unachievable levels of PCI DSS compliance . 1. Outsource processing, storage and transmission of credit card data to a PCI DSS compliant company in such a way that LSE compliance can be achieved under levels defined in 3.2. 2. Change the scope of the project so that LSE

PCI SAQ C-VT Guide Page 3 of 25 Introduction This document has been created to help all University of Tennessee Institute of Agriculture (Institute) merchants completing Payment Card Industry Data Security Standard (PCI DSS) Self-

I have read the PCI DSS and I recognize that I must maintain full PCI DSS compliance at all times. No evidence of magnetic stripe (i.e., track) data 2 , CAV2, CVC2, …

PCI SAQ Certification Process in 10 Easy Steps Please review the following steps regarding the PCI DSS compliance certification process for the Self-Assessment Questionnaires (SAQ) for merchants and service providers: 1. Determine Appropriate Merchant and Service Provider Level. Before you begin down the road of the PCI DSS compliance

Fischer International Identity: Facilitating PCI DSS v.3.2 Compliance Through Identity & Access Management 3 SAQ-D Compliance Requirements Facilitated by IAM The table below contains the applicable PCI DSS SAQ-D requirements with which IAM may facilitate

Attestation of Compliance, SAQ A Instructions for Submission The merchant must complete t his Attestation of Compliance as a declaration of the merchant’s compliance status with the Payment Card Industry Data Security Standard (PCI DSS) Requirements and Security Assessment Procedures. Complete all applicable sections and refer to the submission instructions at “PCI DSS Compliance

The Payment Card Industry Data Security Standards (PCIDSS) is a set of comprehensive requirements for enhancing payment account data security and forms industry best practice for any entity that stores, processes and/or transmits cardholder data.

Payment Card Industry (PCI) Data Security Standard Self-Assessment Questionnaire D and Attestation of Compliance for Service Providers SAQ-Eligible Service Providers

Pci self assessment questionnaire saq PDF results Pci dss self-assessment questionnaire ( saq ) Open document Search by title Preview with Google Docs

PCI DSS v3.2 SAQ A, (Refer to “Network Segmentation” section of PCI DSS for guidance on network segmentation) Yes No We do not store cardholder data. We process Credit Cards via SSL/TLS connections to Stripe.com API backend services. n/a All connections to web servers use SSL/ TLS and all transactions to stripe.com backend API utilize these connections. VoiceIt does NOT store any

The PDF is password protected – and the password is encryption. If you’d like some more training then I can recommend my PCI courses at Pluralsight: Payment Card Security, Processing, and the PCI Standards PCI DSS: The Big Picture. So here are the questions. For each one there is only one correct answer. Enjoy. Q1 What information must be included in the network diagram? A: Firewalls

•PCI DSS 101 •Chip Cards (EMV) PCI Compliance • Focused Solely on •SAQ D for service providers •MICROS Simphony/WK5A registers •Partnered with FreedomPay for P2PE •SAQ A 21. FreedomPay Setup 22. Congratulations! Complying with the PCI DSS is NOT a project. It is an evolving, continuous process that has no end.? 23. Verizon Data Breach Investigations Report Each year, the

PCI Compliance c.ymcdn.com

PAYMENT CARD INDUSTRY DATA SECURITY STANDARD SELF

Attestation of Compliance, SAQ A Instructions for Submission The merchant must complete t his Attestation of Compliance as a declaration of the merchant’s compliance status with the Payment Card Industry Data Security Standard (PCI DSS) Requirements and Security Assessment Procedures. Complete all applicable sections and refer to the submission instructions at “PCI DSS Compliance

Section 2 – PCI DSS Self-Assessment Questionnaire (SAQ D) Section 3 (Parts 3 & 4 of the AOC) – Validation and Attestation Details and Action Plan for Non- Compliant Requirements (if applicable)

APPLICABILITY OF PCI DATA SECURITY STANDARD (PCI DSS) TO CARD CAPTURE METHODS NC Office of the State Controller General Requirements for Merchants

Section 3: Validation and Attestation Details Part 3. PCI DSS Validation This AOC is based on results noted in SAQ D (Section 2), dated 2017-07-19 12:13 PM.

Fischer International Identity: Facilitating PCI DSS v.3.2 Compliance Through Identity & Access Management 3 SAQ-D Compliance Requirements Facilitated by IAM The table below contains the applicable PCI DSS SAQ-D requirements with which IAM may facilitate

PCI DSS Self-Assessment Questionnaire C, Version (SAQ version #), was completed according to the instructions therein. All information within the above-referenced SAQ and in this attestation fairly represents the results of my

Getting Started with the PCI Compliance Service Qualys

PCI Compliance which SAQ is right for me? MWR InfoSecurity

Getting Started with the PCI Compliance Service 7 the component report in PDF, for the network or questionnaire, and saves it in your account so you can download it as needed.

and directly from a PCI DSS validated third-party service provider(s). If you are doing anything other than the processes listed above, you may not complete SAQ A. Please email UTIAsecurity@tennessee.edu if you think you need to change SAQ types.

I have read the PCI DSS and I recognize that I must maintain full PCI DSS compliance at all times. No evidence of magnetic stripe (i.e., track) data 2 , CAV2, CVC2, …

PCIÿ Payment Card Industryÿ 0˙0ü0¿0»0›0å0Œ0˘0£WœnŒ †Œ]æUO−: D R€vß^Š0—0ü0‚0ç0ó 0—0ü0‚0ç0ó 1.2 nŒbà−<f fł

The PCI-DSS Self-Assessment Questionnaire or PCI-DSS SAQ is a compliance validation tool that was developed for small merchants who outsource cardholder data storage to third party providers.

D SAQ D for Merchants: All merchants not included in descriptions for the above SAQ types. SAQ D for Service Providers: All service providers defined by a payment brand as eligible to complete a SAQ. * New for PCI DSS v3.0 . The intent of this document is to provide supplemental information. Information provided here Page 2 does not replace or supersede PCI SSC Security Standards or their

Section 3: Validation and Attestation Details Part 3. PCI DSS Validation This AOC is based on results noted in SAQ D (Section 2), dated 2017-07-19 12:13 PM.

PCI DSS PCI-Guy.com

PCI_DSS_SAQ_DSP_v3-1_Report.pdf Payment Card Industry

PCI DSS is governed by the PCI Security Standards Council (PCI SSC) and is composed of card schemes such as Visa, MasterCard, American Express, Discover and JCB. The PCI SSC set the rules that define the minimum acceptable security standards and requirement for merchants and service providers. PCI DSS applies to all merchants that store, process or transmit Payment Card Data. …

The SAQ is a validation tool intended to assist merchants that are not required to undergo an on-site security assessment, in self-evaluating their compliance with

and directly from a PCI DSS validated third-party service provider(s). If you are doing anything other than the processes listed above, you may not complete SAQ A. Please email UTIAsecurity@tennessee.edu if you think you need to change SAQ types.

The PCI Data Security Standard Self Assessment Questionnaire (SAQ) is a validation tool intended to assist merchants and service providers who are permitted by the payment brands to self-evaluate their compliance with the Payment Card Industry Data Security Standard (PCI DSS).

PCI DSS Requirements and Security Assessment Procedures Documents for your PCI DSS Self-Assessment SAQ Instructions and Guidelines SAO FAQs Information Supplements* and general FAQs Self-Assessment Questionnaires A through D, and P2PE PCI DSS Glossary of Terms, Abbreviations, and Acronyms SAQ Attestations of Compliance . 0 o a (1) O O o x: o E 8 c: e o c 8 v 0-2 — c O o c …

Section 2 – PCI DSS Self-Assessment Questionnaire (SAQ D) Section 3 (Parts 3 & 4 of the AOC) – Validation and Attestation Details and Action Plan for Non- Compliant Requirements (if applicable)

Payment Card Industry (PCI) Data Security Standard Self-Assessment Questionnaire D and Attestation of Compliance for Service Providers SAQ-Eligible Service Providers

Request to Cancel Merchant Account/Return Equipment (pdf) PCI DSS Forms These Self-Assessment Questionnaires (SAQ) are validation tools intended to help merchants self-evaluate their compliance with PCI DSS.

SAQ D Policies Packet for Merchants PCI Policy Portal

PCI SAQ A-EP PCI Compliance Guide

Payment Card Industry (PCI) Data Security Standard Self-Assessment Questionnaire D and Attestation of Compliance for Merchants All other SAQ-Eligible Merchants

As a merchant who is accepting card transactions your bank will require you to complete the correct PCI DSS SAQ for the API type that you are integrating with. This table is a list of eWAY’s API’s and the relevant SAQ that you must complete.

Section 3: Validation and Attestation Details Part 3. PCI DSS Validation This AOC is based on results noted in SAQ D (Section 2), dated 2017-07-19 12:13 PM.

PCI DSS Requirements and Security Assessment Procedures Documents for your PCI DSS Self-Assessment SAQ Instructions and Guidelines SAO FAQs Information Supplements* and general FAQs Self-Assessment Questionnaires A through D, and P2PE PCI DSS Glossary of Terms, Abbreviations, and Acronyms SAQ Attestations of Compliance . 0 o a (1) O O o x: o E 8 c: e o c 8 v 0-2 — c O o c …

and directly from a PCI DSS validated third-party service provider(s). If you are doing anything other than the processes listed above, you may not complete SAQ A. Please email UTIAsecurity@tennessee.edu if you think you need to change SAQ types.

processing), and D. SAQ A-EP is a new addition to PCI compliance, and lies between A (easy) and D (full PCI standard) in complexity. Take a look at the slide to compare eligibility and requirements of each SAQ. SecurityMetrics Ecommerce Guide to PCI DSS 3.0 Before we dive into the ecommerce processing methods, we need to first understand the entities (players) and activities (steps) that …

To clarify requirements there is a document called “Navigating PCI DSS – Understanding the Intent of the Requirements” at www.pcisecuritystandards.org web site. If in doubt about how to interpret the questionnaire in regarding to your operation, please contact and consult a QSA. • By answering Questionnaire C, you are confirming that you do not use any Custom Integration features of

Attestation of Compliance SAQ D—Merchant Version

PCI_DSS_SAQ_DSP_v3-1_Report.pdf Payment Card Industry

and directly from a PCI DSS validated third-party service provider(s). If you are doing anything other than the processes listed above, you may not complete SAQ A. Please email UTIAsecurity@tennessee.edu if you think you need to change SAQ types.

the Vectra PCI DSS Service desk for assistance on 1800558522 or by email to support@vectrapci.com.au When you have setup your IPs/URLs for scanning, click Next.

View our PCI DSS Compliance Certificates below: Certificate of Compliance.pdf. Attestation of Compliance (SAQ-D).pdf. Payment Gateways. Payment Gateways are an e-commerce application provided by merchant services to authorize and process credit card payments in a PCI compliant manner. Setting up RMS to connect with a Payment Gateway merchant account provides the ability …

Payment Card Industry (PCI) Data Security Standard Self-Assessment Questionnaire D and Attestation of Compliance for Merchants All other SAQ-Eligible Merchants

The most complex PCI DSS standard (Self-Assessment Questionnaire D) has 12 requirements (with approximately 63 sub-requirements). The other SAQs are subsets of this “master list” of requirements. The other SAQs are subsets of this “master list” of requirements.

PCI DSS is governed by the PCI Security Standards Council (PCI SSC) and is composed of card schemes such as Visa, MasterCard, American Express, Discover and JCB. The PCI SSC set the rules that define the minimum acceptable security standards and requirement for merchants and service providers. PCI DSS applies to all merchants that store, process or transmit Payment Card Data. …

The SAQ is a validation tool intended to assist merchants that are not required to undergo an on-site security assessment, in self-evaluating their compliance with the

The PDF is password protected – and the password is encryption. If you’d like some more training then I can recommend my PCI courses at Pluralsight: Payment Card Security, Processing, and the PCI Standards PCI DSS: The Big Picture. So here are the questions. For each one there is only one correct answer. Enjoy. Q1 What information must be included in the network diagram? A: Firewalls

The SAQ is a validation tool intended to assist merchants that are not required to undergo an on-site security assessment, in self-evaluating their compliance with

PCI SAQ A-EP PCI Compliance Guide

PCI SAQ Certification Process PCI Policy Portal

As a merchant who is accepting card transactions your bank will require you to complete the correct PCI DSS SAQ for the API type that you are integrating with. This table is a list of eWAY’s API’s and the relevant SAQ that you must complete.

ReymannGroup, Inc. © WatchGuard Company Confidential – PCI DSS SAQ Tool PCI DSS Self Assessment Questionnaire (SAQ) Tool

SAQ D is the final SAQ and applies to any merchants who do not meet the criteria for other SAQs, as well as all service providers. SAQ D encompasses the full set of over 200 requirements and covers the entirety of the PCI DSS .

PCI DSS Self -Assessment Questionnaire D, Version (version of SAQ), was completed according to the instructions therein. All information within the above -referenced SAQ and in this attestation fairly represents the results of my

Fischer International Identity: Facilitating PCI DSS v.3.2 Compliance Through Identity & Access Management 3 SAQ-D Compliance Requirements Facilitated by IAM The table below contains the applicable PCI DSS SAQ-D requirements with which IAM may facilitate

Payment Card Industry (PCI) Data Security Standard Self-Assessment Questionnaire D and Attestation of Compliance for Merchants All other SAQ-Eligible Merchants

Request to Cancel Merchant Account/Return Equipment (pdf) PCI DSS Forms These Self-Assessment Questionnaires (SAQ) are validation tools intended to help merchants self-evaluate their compliance with PCI DSS.

Search for jobs related to Pci saq a or hire on the world’s largest freelancing marketplace with 15m jobs. It’s free to sign up and bid on jobs.

Understanding the SAQs for PCI DSS v3 LeumiCard

SAQ-InstrGuidelines-v3 2 UBC Finance

Section 3: Validation and Attestation Details Part 3. PCI DSS Validation This AOC is based on results noted in SAQ D (Section 2), dated 2017-07-19 12:13 PM.

PCI DSS v3.2 SAQ A, (Refer to “Network Segmentation” section of PCI DSS for guidance on network segmentation) Yes No We do not store cardholder data. We process Credit Cards via SSL/TLS connections to Stripe.com API backend services. n/a All connections to web servers use SSL/ TLS and all transactions to stripe.com backend API utilize these connections. VoiceIt does NOT store any

I have read the PCI DSS and I recognize that I must maintain full PCI DSS compliance at all times. No evidence of magnetic stripe (i.e., track) data 2 , CAV2, CVC2, …

APPLICABILITY OF PCI DATA SECURITY STANDARD (PCI DSS) TO CARD CAPTURE METHODS NC Office of the State Controller General Requirements for Merchants

The most complex PCI DSS standard (Self-Assessment Questionnaire D) has 12 requirements (with approximately 63 sub-requirements). The other SAQs are subsets of this “master list” of requirements. The other SAQs are subsets of this “master list” of requirements.

PCI Self Assessment Questionnaire SAQ PDF documents

PCI DSS v3 2 SAQ D Merchant Jobs Employment Freelancer

The PDF is password protected – and the password is encryption. If you’d like some more training then I can recommend my PCI courses at Pluralsight: Payment Card Security, Processing, and the PCI Standards PCI DSS: The Big Picture. So here are the questions. For each one there is only one correct answer. Enjoy. Q1 What information must be included in the network diagram? A: Firewalls

PCI DSS v3.2 SAQ A, (Refer to “Network Segmentation” section of PCI DSS for guidance on network segmentation) Yes No We do not store cardholder data. We process Credit Cards via SSL/TLS connections to Stripe.com API backend services. n/a All connections to web servers use SSL/ TLS and all transactions to stripe.com backend API utilize these connections. VoiceIt does NOT store any

The PCI DSS SAQ is a validation tool for merchants and service providers not required to undergo an on- site data security assessment per the PCI DSS Requirements and …

Just a quick reminder that the PCI Security Standards Council (PCI SSC) has published a minor revision to the PCI DSS. The PCI DSS has now been updated from version 3.2 to version 3.2.1.

The Payment Card Industry Data Security Standards (PCIDSS) is a set of comprehensive requirements for enhancing payment account data security and forms industry best practice for any entity that stores, processes and/or transmits cardholder data.

cardholder data, are redirected to a PCI DSS validated third-party payment processor’. This reflects the PCI SSC’s This reflects the PCI SSC’s assessment of the increased risk associated with SAQ A-EP eligible ecommerce integration methods.

and directly from a PCI DSS validated third-party service provider(s). If you are doing anything other than the processes listed above, you may not complete SAQ A. Please email UTIAsecurity@tennessee.edu if you think you need to change SAQ types.

D SAQ D for Merchants: All merchants not included in descriptions for the above SAQ types. SAQ D for Service Providers: All service providers defined by a payment brand as eligible to complete a SAQ. * New for PCI DSS v3.0 . The intent of this document is to provide supplemental information. Information provided here Page 2 does not replace or supersede PCI SSC Security Standards or their

Search for jobs related to Pci saq a or hire on the world’s largest freelancing marketplace with 15m jobs. It’s free to sign up and bid on jobs.

The most complex PCI DSS standard (Self-Assessment Questionnaire D) has 12 requirements (with approximately 63 sub-requirements). The other SAQs are subsets of this “master list” of requirements. The other SAQs are subsets of this “master list” of requirements.

The SAQ is a validation tool intended to assist merchants that are not required to undergo an on-site security assessment, in self-evaluating their compliance with the

PCI DSS Requirements and Security Assessment Procedures Documents for your PCI DSS Self-Assessment SAQ Instructions and Guidelines SAO FAQs Information Supplements* and general FAQs Self-Assessment Questionnaires A through D, and P2PE PCI DSS Glossary of Terms, Abbreviations, and Acronyms SAQ Attestations of Compliance . 0 o a (1) O O o x: o E 8 c: e o c 8 v 0-2 — c O o c …

Although this is an incremental PCI DSS release, it’s important to understand how the 3.2 SAQs differ from those issued with PCI DSS v3.1. First, the good news. There are no new SAQs and with this release, the eligibility criteria for each SAQ is essentially the same:

APPLICABILITY OF PCI DATA SECURITY STANDARD (PCI DSS)

pci_dss_saq.pdf Antivirus Software Authentication

SAQ-A 6.2 – This one inclusion has changed the way we need to look at web servers. PCI DSS version 3.2.1 was introduced earlier this year. Until the end of the year you can still assess against the previous version, but time is soon running out.

Just a quick reminder that the PCI Security Standards Council (PCI SSC) has published a minor revision to the PCI DSS. The PCI DSS has now been updated from version 3.2 to version 3.2.1.

Request to Cancel Merchant Account/Return Equipment (pdf) PCI DSS Forms These Self-Assessment Questionnaires (SAQ) are validation tools intended to help merchants self-evaluate their compliance with PCI DSS.

PCI SAQ Certification Process in 10 Easy Steps Please review the following steps regarding the PCI DSS compliance certification process for the Self-Assessment Questionnaires (SAQ) for merchants and service providers: 1. Determine Appropriate Merchant and Service Provider Level. Before you begin down the road of the PCI DSS compliance

PCI DSS Self-Assessment Questionnaire B, Version (version of SAQ), was completed according to the instructions therein. All information within the above-referenced SAQ and in this attestation fairly represents the results of my

Search for jobs related to Pci saq a or hire on the world’s largest freelancing marketplace with 15m jobs. It’s free to sign up and bid on jobs.

The PCI DSS SAQ is a validation tool for merchants and service providers not required to undergo an on- site data security assessment per the PCI DSS Requirements and …

The SAQ is a validation tool intended to assist merchants that are not required to undergo an on-site security assessment, in self-evaluating their compliance with the

PCI DSS Requirements and Security Assessment Procedures Documents for your PCI DSS Self-Assessment SAQ Instructions and Guidelines SAO FAQs Information Supplements* and general FAQs Self-Assessment Questionnaires A through D, and P2PE PCI DSS Glossary of Terms, Abbreviations, and Acronyms SAQ Attestations of Compliance . 0 o a (1) O O o x: o E 8 c: e o c 8 v 0-2 — c O o c …

The SAQ D Policies Packet (Merchants) for Version 3.2 of the PCI DSS standards contains all the necessary PCI policies for compliance with the PCI DSS Self-Assessment Questionnaire D …

The PCI Data Security Standard Self Assessment Questionnaire (SAQ) is a validation tool intended to assist merchants and service providers who are permitted by the payment brands to self-evaluate their compliance with the Payment Card Industry Data Security Standard (PCI DSS).

PCI DSS – More than an IT Upgrade Terra Firma

PCI DSS Compliance Insights Shearwater Solutions

PCI DSS Forms & Procedures UBC Finance

Section 3: Validation and Attestation Details Part 3. PCI DSS Validation This AOC is based on results noted in SAQ D (Section 2), dated 2017-12-13 15:34 PM.

PCI DSS Ingenico ePayments Developers

VoiceIt’s Stripe SAQ-A Compliance.

SAQ-InstrGuidelines-v3 2 UBC Finance

APPLICABILITY OF PCI DATA SECURITY STANDARD (PCI DSS) TO CARD CAPTURE METHODS NC Office of the State Controller General Requirements for Merchants

View SAQ D (PDF) pcisecuritystandards.org

PCI Self Assessment Questionnaire SAQ PDF documents

Request to Cancel Merchant Account/Return Equipment (pdf) PCI DSS Forms These Self-Assessment Questionnaires (SAQ) are validation tools intended to help merchants self-evaluate their compliance with PCI DSS.

Pci saq d pdf WordPress.com

Getting Started with the PCI Compliance Service Qualys

Request to Cancel Merchant Account/Return Equipment (pdf) PCI DSS Forms These Self-Assessment Questionnaires (SAQ) are validation tools intended to help merchants self-evaluate their compliance with PCI DSS.

PCI_DSS_SAQ_DSP_v3-1_Report.pdf Payment Card Industry

Pci saq a Jobs Employment Freelancer

Based on the results noted in the SAQ D dated (completion date of SAQ), (Service Provider Company Name) asserts the following compliance status (check one): En cumplimiento: All sections of the PCI SAQ are complete, and all questions answered ˝yes ˛, resulting in

SAQ D Policies Packet for Merchants PCI Policy Portal

Understanding the SAQs for PCI DSS v3 LeumiCard

PCI DSS Forms & Procedures UBC Finance

processing), and D. SAQ A-EP is a new addition to PCI compliance, and lies between A (easy) and D (full PCI standard) in complexity. Take a look at the slide to compare eligibility and requirements of each SAQ. SecurityMetrics Ecommerce Guide to PCI DSS 3.0 Before we dive into the ecommerce processing methods, we need to first understand the entities (players) and activities (steps) that …

VoiceIt’s Stripe SAQ-A Compliance.

pci_dss_saq.pdf Antivirus Software Authentication

Guidelines for Securing Cardholder Data for your eCommerce

Note: For this SAQ, PCI DSS Requirements that address the protection of computer systems (for example, Requirements 2 and 8) apply to e-commerce merchants that redirect customers from their website to a third party for payment processing, an d specifically to the merchant webserver upon which

PCI_DSS_SAQ_DSP_v3-1_Report.pdf Payment Card Industry

PCI Compliance c.ymcdn.com

Understanding the SAQs for PCI DSS v3 LeumiCard

PCI SAQ C-VT Guide Page 3 of 25 Introduction This document has been created to help all University of Tennessee Institute of Agriculture (Institute) merchants completing Payment Card Industry Data Security Standard (PCI DSS) Self-

PCI DSS Self Assessment Questionnaire (SAQ) Tool

PCI_DSS_SAQ_DSP_v3-1_Report.pdf Payment Card Industry

PCI SAQ HackerGuardian PCI DSS Self Assessment Questionnaire

Pci self assessment questionnaire saq PDF results Pci dss self-assessment questionnaire ( saq ) Open document Search by title Preview with Google Docs

pci_dss_saq.pdf Antivirus Software Authentication

PCI Compliance which SAQ is right for me? MWR InfoSecurity

APPLICABILITY OF PCI DATA SECURITY STANDARD (PCI DSS)

As a merchant who is accepting card transactions your bank will require you to complete the correct PCI DSS SAQ for the API type that you are integrating with. This table is a list of eWAY’s API’s and the relevant SAQ that you must complete.

PCI Compliance c.ymcdn.com

pci_dss_saq.pdf Antivirus Software Authentication

The SAQ D Policies Packet (Merchants) for Version 3.2 of the PCI DSS standards contains all the necessary PCI policies for compliance with the PCI DSS Self-Assessment Questionnaire D …

Attestation of Compliance SAQ A PaySimple

the Vectra PCI DSS Service desk for assistance on 1800558522 or by email to support@vectrapci.com.au When you have setup your IPs/URLs for scanning, click Next.

thirty-two really fun PCIP QSA or ISA revision questions

Payment Card Industry (PCI) Data Security Standard Self-Assessment Questionnaire D and Attestation of Compliance for Merchants All other SAQ-Eligible Merchants

Getting Started with the PCI Compliance Service Qualys

PCI Self Assessment Questionnaire SAQ PDF documents

Data Security Standard Self-Assessment Questionnaire D PCI DSS Version SAQ Revision Description October 2008 1.2 To align content with new PCI DSS v1.2 and to implement minor changes noted since original v1.1. October 2010 2.0 To align content with new PCI DSS v2.0 requirements and testing procedures. February 2014 3.0 To align content with PCI DSS v3.0 requirements and testing …

PDQ Guidelines to PCI Self-Assessment Questionnaire C

Understanding the SAQs for PCI DSS v3 LeumiCard

PCI SAQ HackerGuardian PCI DSS Self Assessment Questionnaire

PDQ Guide for the PCI Data Security Standard Self-Assessment Questionnaire C (Version 1.1) • PDQ has created an Answer Guide for the Payment Card Industry (PCI) Data Security Standard Self-Assessment Questionnaire C to help wash operators complete questionnaires. Part of the Access Customer Management System (CMS) operator manual is the PABP Implementation Guide, which …

An In-Depth Look at the PCI 3.2 SAQs PCI Compliance Guide

Based on the results noted in the SAQ D dated (completion date of SAQ), (Service Provider Company Name) asserts the following compliance status (check one): Compliant: All sections of the PCI SAQ are complete, and all questions answered ˝yes ˛, resulting in an

PCI SAQ A-EP PCI Compliance Guide

Ecommerce Guide to PCI DSS 3 Security

cardholder data, are redirected to a PCI DSS validated third-party payment processor’. This reflects the PCI SSC’s This reflects the PCI SSC’s assessment of the increased risk associated with SAQ A-EP eligible ecommerce integration methods.

Ecommerce Guide to PCI DSS 3 Security

Search for jobs related to PCI DSS v3 2 SAQ D Merchant or hire on the world’s largest freelancing marketplace with 15m+ jobs. It’s free to sign up and bid on jobs.

MERCHANT suncorp.vectrapci.com.au

I have read the PCI DSS and I recognize that I must maintain full PCI DSS compliance at all times. No evidence of magnetic stripe (i.e., track) data 2 , CAV2, CVC2, …

An In-Depth Look at the PCI 3.2 SAQs PCI Compliance Guide

PAYMENT CARD INDUSTRY DATA SECURITY STANDARD SELF

VoiceIt’s Stripe SAQ-A Compliance.

D SAQ D for Merchants: All merchants not included in descriptions for the above SAQ types. SAQ D for Service Providers: All service providers defined by a payment brand as eligible to complete a SAQ. * New for PCI DSS v3.0 . The intent of this document is to provide supplemental information. Information provided here Page 2 does not replace or supersede PCI SSC Security Standards or their

PCI DSS eWAY Singapore

PCI-DSS Self-Assessment Questionnaire Definitions and

PCI DSS Ingenico ePayments Developers

The PCI DSS SAQ is a validation tool for merchants and service providers not required to undergo an on- site data security assessment per the PCI DSS Requirements and …

APPLICABILITY OF PCI DATA SECURITY STANDARD (PCI DSS)

PCI DSS eWAY New Zealand

and directly from a PCI DSS validated third-party service provider(s). If you are doing anything other than the processes listed above, you may not complete SAQ A. Please email UTIAsecurity@tennessee.edu if you think you need to change SAQ types.

Attestation of Compliance SAQ D—Merchant Version

MERCHANT suncorp.vectrapci.com.au

Pci saq d pdf WordPress.com

The PDF is password protected – and the password is encryption. If you’d like some more training then I can recommend my PCI courses at Pluralsight: Payment Card Security, Processing, and the PCI Standards PCI DSS: The Big Picture. So here are the questions. For each one there is only one correct answer. Enjoy. Q1 What information must be included in the network diagram? A: Firewalls

PCI DSS – More than an IT Upgrade Terra Firma

Attestation of Compliance SAQ A PaySimple

Request to Cancel Merchant Account/Return Equipment (pdf) PCI DSS Forms These Self-Assessment Questionnaires (SAQ) are validation tools intended to help merchants self-evaluate their compliance with PCI DSS.

PAYMENT CARD INDUSTRY DATA SECURITY STANDARD SELF

PCIÿ Payment Card Industry 0˙0ü0¿0»0›0å0Œ0˘0£WœnŒ