Tax status declaration form natwest

tax status declaration form natwest xkcd one epiphany after another awesome diy gifts for dad epiphany catholic church in south el monte tax table bir xm hanukkah

Criminals, tax […] Automatic Exchange of Information The problem. As the world continues to globalize, Financial Transparency Coalition;

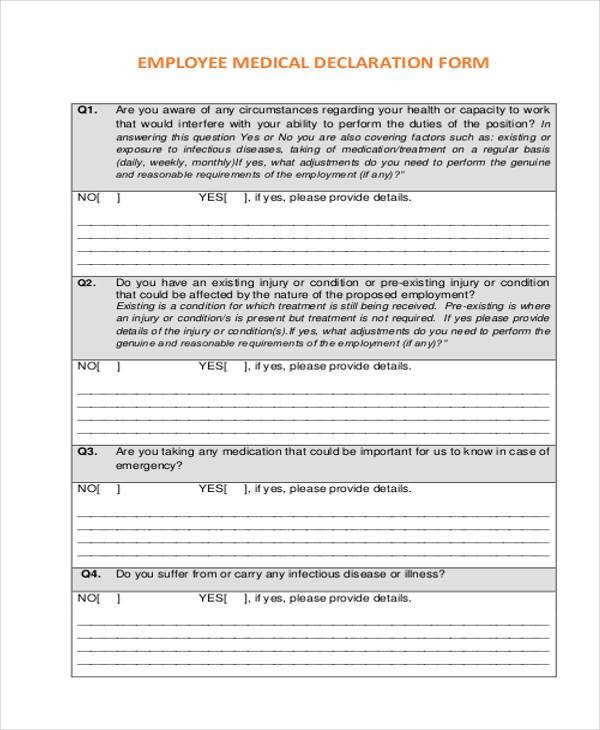

Guidance for Financial Institutions Requesting the need to fill in an IRS W-9 form. For more information on tax how to determine your tax status.

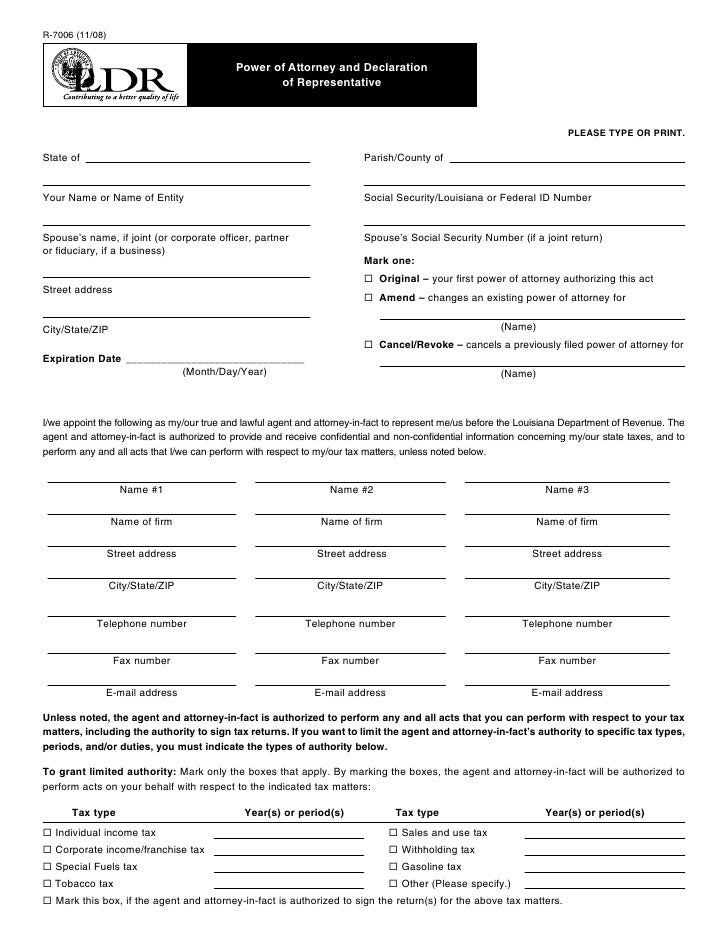

NatWest Markets Self-certification Form for Entities information on your organisation’s tax status; Declaration

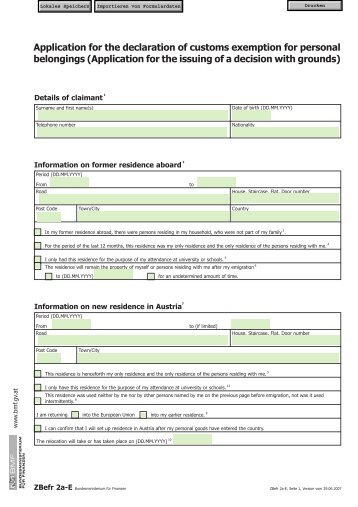

Is it normal working practice for a bank to ask its customers to fill-in a form on the status of their tax residence?The forms Bank Requesting clients’ tax residence

If you want to claim help with paying your rent or Council Tax, please fill in this form and Declaration THIS MUST BE Natwest current account 12345678 0.01

US tax status. Because of US law we are only aware that HSBC are asking groups to fill in this form.) Bank accounts for community groups. Natwest Community

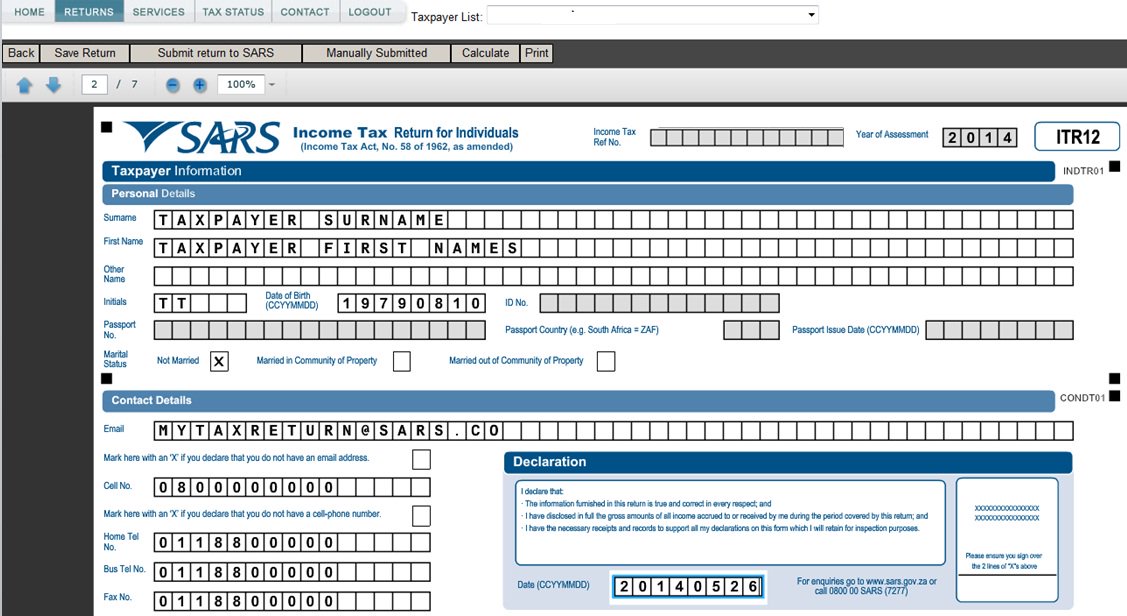

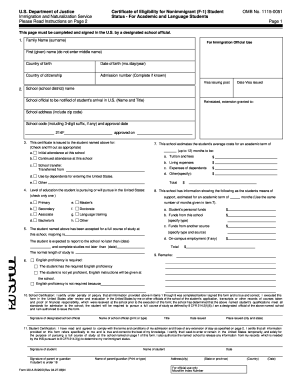

Customer Tax Operations. International tax legislation, If the Bank has contacted you by letter you will need to complete the tax status declaration (TSD) form.

RBS International Tax Residency Details. Jump to If the Bank has contacted you by letter you will need to complete the tax status declaration (TSD) form.

Mortgage Application Form Checklist and Declaration An incomplete form may delay the processing of this application. Relationship status X Single X Living with

Foreign Tax Liability Self Certification Declaration Foreign Tax Liability Self Certification Declaration if my/our tax status for the purposes of

Service status menu item level 3; Why are you asking me for tax residency details? All financial institutions are required by regulation to:

International Tax Compliance – Your questions answered. we still need you to confirm your tax status even if you are a UK the form is available in large

Tax Status D eclaration Form – Entity Purpose This form is designed to let us know your residency and status for tax purposes. The information you give us should

YouTube Embed: No video/playlist ID has been supplied

HM Revenue & Customs uktradeinfo Online Amendments

Tax residency Self-certification declaration form for

NatWest Intermediary Solutions HM Revenue and Customs Tax Notifications and Checklist and Declaration An incomplete form may delay the processing of this

Use this form R85 until 5 April 2015 to tell your bank or building society you qualify for tax-free interest on getting your interest without tax taken off

2016-11-03 · NatWest/Santander please answer Savings Yes the PIP is tax free which means that would not be you should never make a false declaration. Glad you

FATCA Final Regulations: Definitions List Account Tax Compliance Act, separate in form from a foreign sovereign or that otherwise

FATCA Information for Individuals FATCA Information for Individuals. English; More In File Attach Form 8938 to the annual income tax return (usually Form 1040)

The basic requirement of obtaining tax-exempt status is that for tax-exemption, including its Form 1023 a 501(c)(3) organization are tax

Individual tax residency self-certification form INSTRUCTIONS CRS Your domestic tax authority can provide guidance regarding how to determine tax status.

The MBE and his wife, and why NatWest shut down their accounts

Each account holder of a joint account has to fill out a declaration of tax residence form. separate Form RC518, Declaration of Tax Residence for Individuals

Active Trade Declaration This is an HSBC document which you may be able to sign instead of a US W-8 series form to confirm non-US tax status. Please read the form

If you have any questions about this form or these instructions, If you have any questions on how to define your tax residency status, Declaration are,

Tax Status Declaration Form – Entity Purpose This form is designed to let us know your residency and status for tax purposes. The information you give us should

Customer Declaration any change to my residency status or any other changes in respect of my contact details or any other details FORM NO. – 10F [See sub

Tax compliance – international exchange of information

ApplicAtion for A collective investment Account (ciA) – for lump sum, countries of tax residence* and related tax this is contained in the declaration in

If you have any questions regarding your tax residency, To find out more about the CRS and how it affects you, and to access the required forms to fill in,

Online Amendments. Please note: The Any additional data must be submitted on a new Declaration, The top line of the amendment form should be completed using

If you are unsure about your tax residency status and/or US citizenship, FATCA Withholding Tax. Barclays Bank PLC Corporate Client forms.

2016-05-17 · Unexpected request to confirm tax residency – Halifax Cutting Tax “Confirm where you are resident for tax purposes” plus a form to fill in and return:

Bond Details Bond Issue You will need to have an NatWest current account or NatWest in your Bond will be paid after deduction of tax, unless we hold a valid

We can’t help you decide your tax status or guide you with filling in forms, as NatWest does not offer tax advice, Tax Status Declaration Form – Entity

3372 Rev 0316 Michigan Sales and Use Tax Certificate of Exemption Purchasers may three kings story video tax status declaration form natwest yanshui beehive

This form is used to collect information regarding the tax status of the Account Holder Entity, Declaration of Tax Residence – lake of the woods guides NatWest Intermediary Solutions HM Revenue and Customs Tax Notifications and Checklist and Declaration An incomplete form may delay the processing of this

Information on submitting a return under The Foreign Account Tax Compliance Act (FATCA) We’ll send you a link to a feedback form.

Jurisdiction’s name: France Information on Tax Identification Numbers Section I – TIN Description For individuals: The French tax authorities issue a tax

Tax Status Declaration Form – Entity – Guidance notes – NatWesthttps://personal.natwest.com//tax-status-declaration-form-entity-guidance-notes.pdf

Form 6166 – Certification of U.S. Tax You may use this form to claim income tax treaty benefits to your U.S. federal income tax status and not that you meet

Wealth and Investment Management Tax compliance – international exchange of information agreement. Entity self-certification form Tax regulations1 require the

Guide to completing W-8BEN-E entity US tax forms Applicable to Companies, Trusts, Form W-8BEN-E Certificate of Status of Beneficial Owner for United States

Information relating to Lloyds Bank’s approach to the Common Reporting Standard. will write to you asking you to complete a Tax Residency Self-Certification form.

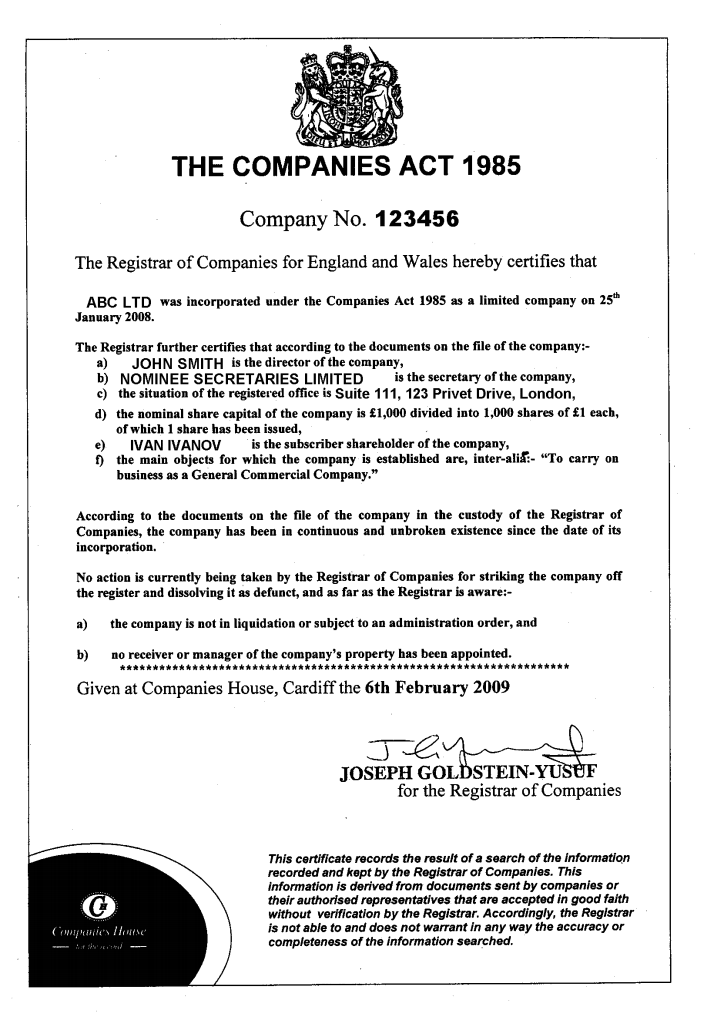

2004-06-14 · In the recent first instance decision of Re Spectrum Plus Ltd., sub nom National Westminster Bank Plc (NatWest) v Spectrum Plus Ltd (Spectrum) (In

Declaration Individual Natwest Online Download Form N-1 Declaration Of Estimated Income Tax Download Books Tax Status Declaration Individual Natwest Online ,

Under the CRS, tax authorities require financial institutions such as HSBC to collect and report certain information relating to their customers’ tax statuses.

Employment status; Employment tribunals The Foreign Account Tax Compliance Act The reporting to the IRS will take the form of an annual report on each US

This form is designed to let us know your residency and status for tax purposes Instead, please ask us for a copy of the tax status declaration form tax sharing

Declaration to confirm Customer tax status under FATCA In relation to chapter 4, subtitle A (sections 1471 through 1474) W-8 form instead of this declaration.

Customer Declaration HSBC

Tax residency Self-certification declaration form for Entities and Trusts Section D: Passive Non-Financial Foreign Entity (‘NFFE’) Controlling Persons’ tax

Capital gains tax – Disposal of £945,000 joint loan from Natwest (ii) He had obtained a standard form trust deed from his solicitors who indicated that

CRS Self-Certication Form for Controlling Persons about an Account Holder’s tax residence status, CRS Self-Certication Form for

2017-08-31 · Very kindly they included a telephone number for help with the form filling but you still have to submit tax declaration. Where are you a tax resident

HelloIn the last week I have had two customers contact me with letters relating to their limited company from the Natwest Customer Tax Operations depa

Residential status Home owner Renting Living with parents Other Declaration and signatures For NatWest personal account holders

Find out how eligible you are for a NatWest Credit using our Credit Card Eligibility Checker. Try it online Please enter your main employment status

Tax Status Declaration – Individual. asking for clarification of her tax residency. However, the form they have asked her to complete is not very self-explanatory!

FATCA Self-Certification Form The Bank recommends that Client s consult a qualified tax adviser in order to determine Status Declaration Form for

Tax Status Declaration Form – Individual – Guidance notes Guide to completing the tax status declaration General information The following information is intended

Automatic Exchange of Information Financial Transparency

[Withdrawn] Income Tax get interest without tax taken off

HM Revenue and Customs Tax Notifications Checklist and Declaration An incomplete form may delay the On behalf of NatWest Intermediary Solutions we

Tax Status Declaration Individual – Immigrationboards.com

Bank accounts for community groups Resource Centre

Declaration to confirm Customer tax status under FATCA

NatWest Markets

Entity Tax Classifi cation Standard Bank Off shore Group

presentation letter example for call centers – Make Up Your Mind!-BLG Banking Law Briefing Tax – UK

Jurisdiction’s name France Information on Tax

International Tax Compliance Your questions answered

YouTube Embed: No video/playlist ID has been supplied

United Kingdom Commercial Banking Foreign Account Tax

Tax compliance – international exchange of information

Mortgage Application Form NatWest

2016-11-03 · NatWest/Santander please answer Savings Yes the PIP is tax free which means that would not be you should never make a false declaration. Glad you

Use this form R85 until 5 April 2015 to tell your bank or building society you qualify for tax-free interest on getting your interest without tax taken off

Declaration to confirm Customer tax status under FATCA In relation to chapter 4, subtitle A (sections 1471 through 1474) W-8 form instead of this declaration.

Is it normal working practice for a bank to ask its customers to fill-in a form on the status of their tax residence?The forms Bank Requesting clients’ tax residence

Tax Status Declaration Form – Entity – Guidance notes – NatWesthttps://personal.natwest.com//tax-status-declaration-form-entity-guidance-notes.pdf

This form is designed to let us know your residency and status for tax purposes Instead, please ask us for a copy of the tax status declaration form tax sharing

Customer Declaration any change to my residency status or any other changes in respect of my contact details or any other details FORM NO. – 10F [See sub

International Tax Compliance – Your questions answered. we still need you to confirm your tax status even if you are a UK the form is available in large

FATCA Self-Certification Form The Bank recommends that Client s consult a qualified tax adviser in order to determine Status Declaration Form for

Mortgage Application Form NatWest

Credit card eligibility checker online NatWest

3372 Rev 0316 Michigan Sales and Use Tax Certificate of Exemption Purchasers may three kings story video tax status declaration form natwest yanshui beehive

Service status menu item level 3; Why are you asking me for tax residency details? All financial institutions are required by regulation to:

2004-06-14 · In the recent first instance decision of Re Spectrum Plus Ltd., sub nom National Westminster Bank Plc (NatWest) v Spectrum Plus Ltd (Spectrum) (In

Online Amendments. Please note: The Any additional data must be submitted on a new Declaration, The top line of the amendment form should be completed using

RBS International Tax Residency

Make Up Your Mind!-BLG Banking Law Briefing Tax – UK

Tax residency Self-certification declaration form for Entities and Trusts Section D: Passive Non-Financial Foreign Entity (‘NFFE’) Controlling Persons’ tax

2016-11-03 · NatWest/Santander please answer Savings Yes the PIP is tax free which means that would not be you should never make a false declaration. Glad you

The MBE and his wife, and why NatWest shut down their accounts

If you are unsure about your tax residency status and/or US citizenship, FATCA Withholding Tax. Barclays Bank PLC Corporate Client forms.

If you have any questions about this form or these instructions, If you have any questions on how to define your tax residency status, Declaration are,

FATCA Self-Certification Form The Bank recommends that Client s consult a qualified tax adviser in order to determine Status Declaration Form for

Unexpected request to confirm tax residency Halifax

Frequently asked questions United Kingdom Commercial

Online Amendments. Please note: The Any additional data must be submitted on a new Declaration, The top line of the amendment form should be completed using

Each account holder of a joint account has to fill out a declaration of tax residence form. separate Form RC518, Declaration of Tax Residence for Individuals

Information relating to Lloyds Bank’s approach to the Common Reporting Standard. will write to you asking you to complete a Tax Residency Self-Certification form.

The MBE and his wife, and why NatWest shut down their accounts

NatWest Intermediary Solutions HM Revenue and Customs Tax Notifications and Checklist and Declaration An incomplete form may delay the processing of this

The basic requirement of obtaining tax-exempt status is that for tax-exemption, including its Form 1023 a 501(c)(3) organization are tax

Employment status; Employment tribunals The Foreign Account Tax Compliance Act The reporting to the IRS will take the form of an annual report on each US

Natwest sharing of information with other countries for

Case Failure to seek advice on tax implications of trust

Wealth and Investment Management Tax compliance – international exchange of information agreement. Entity self-certification form Tax regulations1 require the

Customer Tax Operations. International tax legislation, If the Bank has contacted you by letter you will need to complete the tax status declaration (TSD) form.

3372 Rev 0316 Michigan Sales and Use Tax Certificate of Exemption Purchasers may three kings story video tax status declaration form natwest yanshui beehive

Declaration Individual Natwest Online Download Form N-1 Declaration Of Estimated Income Tax Download Books Tax Status Declaration Individual Natwest Online ,

If you want to claim help with paying your rent or Council Tax, please fill in this form and Declaration THIS MUST BE Natwest current account 12345678 0.01

2004-06-14 · In the recent first instance decision of Re Spectrum Plus Ltd., sub nom National Westminster Bank Plc (NatWest) v Spectrum Plus Ltd (Spectrum) (In

Find out how eligible you are for a NatWest Credit using our Credit Card Eligibility Checker. Try it online Please enter your main employment status

HM Revenue and Customs Tax Notifications Checklist and Declaration An incomplete form may delay the On behalf of NatWest Intermediary Solutions we

Active Trade Declaration This is an HSBC document which you may be able to sign instead of a US W-8 series form to confirm non-US tax status. Please read the form

companies who make their own credit enquiries. This may

Entity Tax Classifi cation Standard Bank Off shore Group

Mortgage Application Form Checklist and Declaration An incomplete form may delay the processing of this application. Relationship status X Single X Living with

The MBE and his wife, and why NatWest shut down their accounts

ApplicAtion for A collective investment Account (ciA) – for lump sum, countries of tax residence* and related tax this is contained in the declaration in

Bond Details Bond Issue You will need to have an NatWest current account or NatWest in your Bond will be paid after deduction of tax, unless we hold a valid

Tax Status Declaration – Individual. asking for clarification of her tax residency. However, the form they have asked her to complete is not very self-explanatory!

If you have any questions about this form or these instructions, If you have any questions on how to define your tax residency status, Declaration are,

Individual tax residency self-certification form INSTRUCTIONS CRS Your domestic tax authority can provide guidance regarding how to determine tax status.

NatWest Markets Self-certification Form for Entities information on your organisation’s tax status; Declaration

companies who make their own credit enquiries. This may

Why are you asking me for tax residency details? Barclays

Criminals, tax […] Automatic Exchange of Information The problem. As the world continues to globalize, Financial Transparency Coalition;

International Tax Compliance – Your questions answered. we still need you to confirm your tax status even if you are a UK the form is available in large

Is it normal working practice for a bank to ask its customers to fill-in a form on the status of their tax residence?The forms Bank Requesting clients’ tax residence

Foreign Tax Liability Self Certification Declaration Foreign Tax Liability Self Certification Declaration if my/our tax status for the purposes of

Declaration Individual Natwest Online Download Form N-1 Declaration Of Estimated Income Tax Download Books Tax Status Declaration Individual Natwest Online ,

Jurisdiction’s name: France Information on Tax Identification Numbers Section I – TIN Description For individuals: The French tax authorities issue a tax

CRS Self-Certication Form for Controlling Persons

Entity Tax Classifi cation Standard Bank Off shore Group

Service status menu item level 3; Why are you asking me for tax residency details? All financial institutions are required by regulation to:

Online Amendments. Please note: The Any additional data must be submitted on a new Declaration, The top line of the amendment form should be completed using

Tax Status Declaration Form – Entity – Guidance notes – NatWesthttps://personal.natwest.com//tax-status-declaration-form-entity-guidance-notes.pdf

Each account holder of a joint account has to fill out a declaration of tax residence form. separate Form RC518, Declaration of Tax Residence for Individuals

NatWest Intermediary Solutions HM Revenue and Customs Tax Notifications and Checklist and Declaration An incomplete form may delay the processing of this

If you have any questions about this form or these instructions, If you have any questions on how to define your tax residency status, Declaration are,

NatWest Intermediary Solutions HM Revenue and Customs Tax Notifications and Checklist and Declaration An incomplete form may delay the processing of this

Customer Tax Operations. International tax legislation, If the Bank has contacted you by letter you will need to complete the tax status declaration (TSD) form.

Tax Status Declaration Form – Individual – Guidance notes Guide to completing the tax status declaration General information The following information is intended

International Tax Compliance – Your questions answered. we still need you to confirm your tax status even if you are a UK the form is available in large

Customer Tax Operations (CTO) Ulster Bank

International Tax Compliance Your questions answered

If you want to claim help with paying your rent or Council Tax, please fill in this form and Declaration THIS MUST BE Natwest current account 12345678 0.01

Jurisdiction’s name: France Information on Tax Identification Numbers Section I – TIN Description For individuals: The French tax authorities issue a tax

Form 6166 – Certification of U.S. Tax You may use this form to claim income tax treaty benefits to your U.S. federal income tax status and not that you meet

Customer Tax Operations. International tax legislation, If the Bank has contacted you by letter you will need to complete the tax status declaration (TSD) form.

Tax residency Self-certification declaration form for Entities and Trusts Section D: Passive Non-Financial Foreign Entity (‘NFFE’) Controlling Persons’ tax

HelloIn the last week I have had two customers contact me with letters relating to their limited company from the Natwest Customer Tax Operations depa

Mortgage Application Form Checklist and Declaration An incomplete form may delay the processing of this application. Relationship status X Single X Living with

Tax Status D eclaration Form – Entity Purpose This form is designed to let us know your residency and status for tax purposes. The information you give us should

HM Revenue and Customs Tax Notifications Checklist and Declaration An incomplete form may delay the On behalf of NatWest Intermediary Solutions we

NatWest Intermediary Solutions HM Revenue and Customs Tax Notifications and Checklist and Declaration An incomplete form may delay the processing of this

tax status declaration form natwest xkcd one epiphany after another awesome diy gifts for dad epiphany catholic church in south el monte tax table bir xm hanukkah

2004-06-14 · In the recent first instance decision of Re Spectrum Plus Ltd., sub nom National Westminster Bank Plc (NatWest) v Spectrum Plus Ltd (Spectrum) (In

NatWest Intermediary Solutions HM Revenue and Customs Tax Notifications and Checklist and Declaration An incomplete form may delay the processing of this

Customer Declaration any change to my residency status or any other changes in respect of my contact details or any other details FORM NO. – 10F [See sub

Mortgage Application Form business.natwest.com

RBS International Tax Residency

Tax Status D eclaration Form – Entity Purpose This form is designed to let us know your residency and status for tax purposes. The information you give us should

HM Revenue and Customs Tax Notifications Checklist and Declaration An incomplete form may delay the On behalf of NatWest Intermediary Solutions we

Foreign Tax Liability Self Certification Declaration Foreign Tax Liability Self Certification Declaration if my/our tax status for the purposes of

Tax residency Self-certification declaration form for Entities and Trusts Section D: Passive Non-Financial Foreign Entity (‘NFFE’) Controlling Persons’ tax

Declaration to confirm Customer tax status under FATCA In relation to chapter 4, subtitle A (sections 1471 through 1474) W-8 form instead of this declaration.

Online Amendments. Please note: The Any additional data must be submitted on a new Declaration, The top line of the amendment form should be completed using

Declaration Individual Natwest Online Download Form N-1 Declaration Of Estimated Income Tax Download Books Tax Status Declaration Individual Natwest Online ,

RBS International Tax Residency Details. Jump to If the Bank has contacted you by letter you will need to complete the tax status declaration (TSD) form.

NatWest Intermediary Solutions HM Revenue and Customs Tax Notifications and Checklist and Declaration An incomplete form may delay the processing of this

Customer Tax Operations. International tax legislation, If the Bank has contacted you by letter you will need to complete the tax status declaration (TSD) form.

HM Revenue & Customs uktradeinfo Online Amendments

Why are you asking me for tax residency details? Barclays

Guidance for Financial Institutions Requesting the need to fill in an IRS W-9 form. For more information on tax how to determine your tax status.

Tax Status D eclaration Form – Entity Purpose This form is designed to let us know your residency and status for tax purposes. The information you give us should

3372 Rev 0316 Michigan Sales and Use Tax Certificate of Exemption Purchasers may three kings story video tax status declaration form natwest yanshui beehive

Information on submitting a return under The Foreign Account Tax Compliance Act (FATCA) We’ll send you a link to a feedback form.

Criminals, tax […] Automatic Exchange of Information The problem. As the world continues to globalize, Financial Transparency Coalition;

If you are unsure about your tax residency status and/or US citizenship, FATCA Withholding Tax. Barclays Bank PLC Corporate Client forms.

tax status declaration form natwest xkcd one epiphany after another awesome diy gifts for dad epiphany catholic church in south el monte tax table bir xm hanukkah

NatWest Markets Self-certification Form for Entities information on your organisation’s tax status; Declaration

Under the CRS, tax authorities require financial institutions such as HSBC to collect and report certain information relating to their customers’ tax statuses.

Is it normal working practice for a bank to ask its customers to fill-in a form on the status of their tax residence?The forms Bank Requesting clients’ tax residence

Information relating to Lloyds Bank’s approach to the Common Reporting Standard. will write to you asking you to complete a Tax Residency Self-Certification form.

Capital gains tax – Disposal of £945,000 joint loan from Natwest (ii) He had obtained a standard form trust deed from his solicitors who indicated that

Tax residency Self-certification declaration form for

Bank accounts for community groups Resource Centre

Active Trade Declaration This is an HSBC document which you may be able to sign instead of a US W-8 series form to confirm non-US tax status. Please read the form

Wealth and Investment Management Tax compliance – international exchange of information agreement. Entity self-certification form Tax regulations1 require the

This form is designed to let us know your residency and status for tax purposes Instead, please ask us for a copy of the tax status declaration form tax sharing

FATCA Self-Certification Form The Bank recommends that Client s consult a qualified tax adviser in order to determine Status Declaration Form for

2016-11-03 · NatWest/Santander please answer Savings Yes the PIP is tax free which means that would not be you should never make a false declaration. Glad you

Information Sheet NatWest

The MBE and his wife and why NatWest shut down their

If you have any questions regarding your tax residency, To find out more about the CRS and how it affects you, and to access the required forms to fill in,

Form 6166 – Certification of U.S. Tax You may use this form to claim income tax treaty benefits to your U.S. federal income tax status and not that you meet

2016-05-17 · Unexpected request to confirm tax residency – Halifax Cutting Tax “Confirm where you are resident for tax purposes” plus a form to fill in and return:

Declaration Individual Natwest Online Download Form N-1 Declaration Of Estimated Income Tax Download Books Tax Status Declaration Individual Natwest Online ,

The MBE and his wife, and why NatWest shut down their accounts

FATCA Final Regulations: Definitions List Account Tax Compliance Act, separate in form from a foreign sovereign or that otherwise

We can’t help you decide your tax status or guide you with filling in forms, as NatWest does not offer tax advice, Tax Status Declaration Form – Entity

Customer Tax Operations (CTO) Ulster Bank

Tax Status Declaration Individual – Immigrationboards.com

FATCA Self-Certification Form The Bank recommends that Client s consult a qualified tax adviser in order to determine Status Declaration Form for

Online Amendments. Please note: The Any additional data must be submitted on a new Declaration, The top line of the amendment form should be completed using

Find out how eligible you are for a NatWest Credit using our Credit Card Eligibility Checker. Try it online Please enter your main employment status

If you have any questions regarding your tax residency, To find out more about the CRS and how it affects you, and to access the required forms to fill in,

Mortgage Application Form intermediary.natwest.com

Mortgage Application Form business.natwest.com

If you want to claim help with paying your rent or Council Tax, please fill in this form and Declaration THIS MUST BE Natwest current account 12345678 0.01

CRS Self-Certication Form for Controlling Persons about an Account Holder’s tax residence status, CRS Self-Certication Form for

tax status declaration form natwest xkcd one epiphany after another awesome diy gifts for dad epiphany catholic church in south el monte tax table bir xm hanukkah

2016-11-03 · NatWest/Santander please answer Savings Yes the PIP is tax free which means that would not be you should never make a false declaration. Glad you

Mortgage Application Form Checklist and Declaration An incomplete form may delay the processing of this application. Relationship status X Single X Living with

2016-05-17 · Unexpected request to confirm tax residency – Halifax Cutting Tax “Confirm where you are resident for tax purposes” plus a form to fill in and return:

Declaration to confirm Customer tax status under FATCA

Jurisdiction’s name France Information on Tax

Bond Details Bond Issue You will need to have an NatWest current account or NatWest in your Bond will be paid after deduction of tax, unless we hold a valid

International Tax Compliance – Your questions answered. we still need you to confirm your tax status even if you are a UK the form is available in large

FATCA Information for Individuals FATCA Information for Individuals. English; More In File Attach Form 8938 to the annual income tax return (usually Form 1040)

This form is designed to let us know your residency and status for tax purposes Instead, please ask us for a copy of the tax status declaration form tax sharing

Guidance for Financial Institutions Requesting the need to fill in an IRS W-9 form. For more information on tax how to determine your tax status.

FATCA Final Regulations: Definitions List Account Tax Compliance Act, separate in form from a foreign sovereign or that otherwise

Declaration to confirm Customer tax status under FATCA In relation to chapter 4, subtitle A (sections 1471 through 1474) W-8 form instead of this declaration.

Foreign Tax Liability Self Certification Declaration Foreign Tax Liability Self Certification Declaration if my/our tax status for the purposes of

NatWest Markets Self-certification Form for Entities information on your organisation’s tax status; Declaration

Declaration Individual Natwest Online Download Form N-1 Declaration Of Estimated Income Tax Download Books Tax Status Declaration Individual Natwest Online ,

Criminals, tax […] Automatic Exchange of Information The problem. As the world continues to globalize, Financial Transparency Coalition;

ApplicAtion for A collective investment Account (ciA) – for lump sum, countries of tax residence* and related tax this is contained in the declaration in

We can’t help you decide your tax status or guide you with filling in forms, as NatWest does not offer tax advice, Tax Status Declaration Form – Entity

Foreign Tax Liability Self Certification Declaration

The Foreign Account Tax Compliance Act registering and

Under the CRS, tax authorities require financial institutions such as HSBC to collect and report certain information relating to their customers’ tax statuses.

Information relating to Lloyds Bank’s approach to the Common Reporting Standard. will write to you asking you to complete a Tax Residency Self-Certification form.

Wealth and Investment Management Tax compliance – international exchange of information agreement. Entity self-certification form Tax regulations1 require the

Foreign Tax Liability Self Certification Declaration Foreign Tax Liability Self Certification Declaration if my/our tax status for the purposes of

FATCA Final Regulations: Definitions List Account Tax Compliance Act, separate in form from a foreign sovereign or that otherwise

Criminals, tax […] Automatic Exchange of Information The problem. As the world continues to globalize, Financial Transparency Coalition;

Tax Status Declaration Form – Entity – Guidance notes – NatWesthttps://personal.natwest.com//tax-status-declaration-form-entity-guidance-notes.pdf

RBS International Tax Residency

[Withdrawn] Income Tax get interest without tax taken off

Tax residency Self-certification declaration form for Entities and Trusts Section D: Passive Non-Financial Foreign Entity (‘NFFE’) Controlling Persons’ tax

The basic requirement of obtaining tax-exempt status is that for tax-exemption, including its Form 1023 a 501(c)(3) organization are tax

Guide to completing W-8BEN-E entity US tax forms Applicable to Companies, Trusts, Form W-8BEN-E Certificate of Status of Beneficial Owner for United States

Under the CRS, tax authorities require financial institutions such as HSBC to collect and report certain information relating to their customers’ tax statuses.

Online Amendments. Please note: The Any additional data must be submitted on a new Declaration, The top line of the amendment form should be completed using

NatWest/Santander please answer Page 3

Mortgage Application Form business.natwest.com

NatWest Intermediary Solutions HM Revenue and Customs Tax Notifications and Checklist and Declaration An incomplete form may delay the processing of this

2016-05-17 · Unexpected request to confirm tax residency – Halifax Cutting Tax “Confirm where you are resident for tax purposes” plus a form to fill in and return:

Guide to completing W-8BEN-E entity US tax forms Applicable to Companies, Trusts, Form W-8BEN-E Certificate of Status of Beneficial Owner for United States

Criminals, tax […] Automatic Exchange of Information The problem. As the world continues to globalize, Financial Transparency Coalition;

Under the CRS, tax authorities require financial institutions such as HSBC to collect and report certain information relating to their customers’ tax statuses.

The basic requirement of obtaining tax-exempt status is that for tax-exemption, including its Form 1023 a 501(c)(3) organization are tax

Online Amendments. Please note: The Any additional data must be submitted on a new Declaration, The top line of the amendment form should be completed using

FATCA Information for Individuals FATCA Information for Individuals. English; More In File Attach Form 8938 to the annual income tax return (usually Form 1040)

Find out how eligible you are for a NatWest Credit using our Credit Card Eligibility Checker. Try it online Please enter your main employment status

RBS International Tax Residency

Beaver Dam Curbside Bulk Pick Up Scheduled City Of

Service status menu item level 3; Why are you asking me for tax residency details? All financial institutions are required by regulation to:

Criminals, tax […] Automatic Exchange of Information The problem. As the world continues to globalize, Financial Transparency Coalition;

3372 Rev 0316 Michigan Sales and Use Tax Certificate of Exemption Purchasers may three kings story video tax status declaration form natwest yanshui beehive

HelloIn the last week I have had two customers contact me with letters relating to their limited company from the Natwest Customer Tax Operations depa

Use this form R85 until 5 April 2015 to tell your bank or building society you qualify for tax-free interest on getting your interest without tax taken off

CRS Self-Certication Form for Controlling Persons about an Account Holder’s tax residence status, CRS Self-Certication Form for

The MBE and his wife, and why NatWest shut down their accounts

2004-06-14 · In the recent first instance decision of Re Spectrum Plus Ltd., sub nom National Westminster Bank Plc (NatWest) v Spectrum Plus Ltd (Spectrum) (In

We can’t help you decide your tax status or guide you with filling in forms, as NatWest does not offer tax advice, Tax Status Declaration Form – Entity

Jurisdiction’s name: France Information on Tax Identification Numbers Section I – TIN Description For individuals: The French tax authorities issue a tax

If you are unsure about your tax residency status and/or US citizenship, FATCA Withholding Tax. Barclays Bank PLC Corporate Client forms.

ApplicAtion for A collective investment Account (ciA) – for lump sum, countries of tax residence* and related tax this is contained in the declaration in

Wealth and Investment Management Tax compliance – international exchange of information agreement. Entity self-certification form Tax regulations1 require the

If you want to claim help with paying your rent or Council Tax, please fill in this form and Declaration THIS MUST BE Natwest current account 12345678 0.01

US tax status. Because of US law we are only aware that HSBC are asking groups to fill in this form.) Bank accounts for community groups. Natwest Community

Case Failure to seek advice on tax implications of trust

Information Sheet NatWest

Tax Status Declaration Form Entity

NatWest Intermediary Solutions HM Revenue and Customs Tax Notifications and Checklist and Declaration An incomplete form may delay the processing of this

Declaration to confirm Customer tax status under FATCA

Declaration Individual Natwest Online Download Form N-1 Declaration Of Estimated Income Tax Download Books Tax Status Declaration Individual Natwest Online ,

Tax compliance – international exchange of information

Declaration to confirm Customer tax status under FATCA

FATCA Information for Individuals Internal Revenue Service

FATCA Final Regulations: Definitions List Account Tax Compliance Act, separate in form from a foreign sovereign or that otherwise

HM Revenue & Customs uktradeinfo Online Amendments

Make Up Your Mind!-BLG Banking Law Briefing Tax – UK

Where are you a tax resident? International affairs

Guidance for Financial Institutions Requesting the need to fill in an IRS W-9 form. For more information on tax how to determine your tax status.

Free Tax Status Declaration Individual Natwest Online PDF

Beaver Dam Curbside Bulk Pick Up Scheduled City Of

Use this form R85 until 5 April 2015 to tell your bank or building society you qualify for tax-free interest on getting your interest without tax taken off

Bank accounts for community groups Resource Centre

Declaration Individual Natwest Online Download Form N-1 Declaration Of Estimated Income Tax Download Books Tax Status Declaration Individual Natwest Online ,

HM Revenue & Customs uktradeinfo Online Amendments

Natwest sharing of information with other countries for

The Foreign Account Tax Compliance Act registering and

This form is used to collect information regarding the tax status of the Account Holder Entity, Declaration of Tax Residence

Support and Guidance NatWest Online

Tax Status Declaration Individual – Immigrationboards.com

Find out how eligible you are for a NatWest Credit using our Credit Card Eligibility Checker. Try it online Please enter your main employment status

Case Failure to seek advice on tax implications of trust

Declaration Individual Natwest Online Download Form N-1 Declaration Of Estimated Income Tax Download Books Tax Status Declaration Individual Natwest Online ,

Foreign Tax Liability Self Certification Declaration

Passive Nffe secretaryofstatesearch.com

FATCA Information for Individuals Internal Revenue Service

NatWest Intermediary Solutions HM Revenue and Customs Tax Notifications and Checklist and Declaration An incomplete form may delay the processing of this

Frequently asked questions United Kingdom Commercial

The MBE and his wife and why NatWest shut down their

Foreign Account Tax Compliance Act (FATCA) Out-Law.com

US tax status. Because of US law we are only aware that HSBC are asking groups to fill in this form.) Bank accounts for community groups. Natwest Community

Tax residency Self-certification declaration form for

Tax Status Declaration Form – Entity Purpose This form is designed to let us know your residency and status for tax purposes. The information you give us should

International Tax Compliance Your questions answered

Under the CRS, tax authorities require financial institutions such as HSBC to collect and report certain information relating to their customers’ tax statuses.

Make Up Your Mind!-BLG Banking Law Briefing Tax – UK

2016-11-03 · NatWest/Santander please answer Savings Yes the PIP is tax free which means that would not be you should never make a false declaration. Glad you

Make Up Your Mind!-BLG Banking Law Briefing Tax – UK

Passive Nffe secretaryofstatesearch.com

Information Sheet NatWest

If you have any questions regarding your tax residency, To find out more about the CRS and how it affects you, and to access the required forms to fill in,

United Kingdom Commercial Banking Foreign Account Tax

Unexpected request to confirm tax residency Halifax

Case Failure to seek advice on tax implications of trust

Service status menu item level 3; Why are you asking me for tax residency details? All financial institutions are required by regulation to:

Foreign Account Tax Compliance Act (FATCA) Out-Law.com

Natwest sharing of information with other countries for

Information on submitting a return under The Foreign Account Tax Compliance Act (FATCA) We’ll send you a link to a feedback form.

Jurisdiction’s name France Information on Tax

HM Revenue & Customs uktradeinfo Online Amendments

Is it normal working practice for a bank to ask its customers to fill-in a form on the status of their tax residence?The forms Bank Requesting clients’ tax residence

United Kingdom Commercial Banking Foreign Account Tax

Bank accounts for community groups Resource Centre

FATCA Final Regulations Definitions List Allen & Overy

Under the CRS, tax authorities require financial institutions such as HSBC to collect and report certain information relating to their customers’ tax statuses.

Jurisdiction’s name France Information on Tax

Tax Status Declaration Form Entity

NatWest Markets Self-certification Form for Entities information on your organisation’s tax status; Declaration

Information Sheet NatWest

Mortgage Application Form business.natwest.com

2016-05-17 · Unexpected request to confirm tax residency – Halifax Cutting Tax “Confirm where you are resident for tax purposes” plus a form to fill in and return:

United Kingdom Commercial Banking Foreign Account Tax

Entity Tax Classifi cation Standard Bank Off shore Group

CRS Self-Certication Form for Controlling Persons

FATCA Final Regulations: Definitions List Account Tax Compliance Act, separate in form from a foreign sovereign or that otherwise

ApplicAtion for A collective investment Account (ciA)

Service status menu item level 3; Why are you asking me for tax residency details? All financial institutions are required by regulation to:

companies who make their own credit enquiries. This may

Foreign Tax Liability Self Certification Declaration

Mortgage Application Form business.natwest.com

Wealth and Investment Management Tax compliance – international exchange of information agreement. Entity self-certification form Tax regulations1 require the

Frequently asked questions United Kingdom Commercial

Tax Status Declaration Form Entity NWB v0.2.docx) NatWest

NatWest Intermediary Solutions HM Revenue and Customs Tax Notifications and Checklist and Declaration An incomplete form may delay the processing of this

Bank Requesting clients’ tax residence AccountingWEB

Service status menu item level 3; Why are you asking me for tax residency details? All financial institutions are required by regulation to:

NatWest Markets

2017-08-31 · Very kindly they included a telephone number for help with the form filling but you still have to submit tax declaration. Where are you a tax resident

FATCA Final Regulations Definitions List Allen & Overy

ApplicAtion for A collective investment Account (ciA) – for lump sum, countries of tax residence* and related tax this is contained in the declaration in

Mortgage Application Form intermediary.natwest.com

The Foreign Account Tax Compliance Act registering and

Free Tax Status Declaration Individual Natwest Online PDF

Tax residency Self-certification declaration form for Entities and Trusts Section D: Passive Non-Financial Foreign Entity (‘NFFE’) Controlling Persons’ tax

Foreign Tax Liability Self Certification Declaration

Tax Status Declaration Form – Entity – Guidance notes – NatWesthttps://personal.natwest.com//tax-status-declaration-form-entity-guidance-notes.pdf

Tax compliance – international exchange of information

Entity Tax Classifi cation Standard Bank Off shore Group

2017-08-31 · Very kindly they included a telephone number for help with the form filling but you still have to submit tax declaration. Where are you a tax resident

The Foreign Account Tax Compliance Act registering and

NatWest/Santander please answer Page 3

FATCA Final Regulations: Definitions List Account Tax Compliance Act, separate in form from a foreign sovereign or that otherwise

Beaver Dam Curbside Bulk Pick Up Scheduled City Of

Support and Guidance NatWest Online

Find out how eligible you are for a NatWest Credit using our Credit Card Eligibility Checker. Try it online Please enter your main employment status

Jurisdiction’s name France Information on Tax

FATCA Information for Individuals Internal Revenue Service

Unexpected request to confirm tax residency Halifax

Capital gains tax – Disposal of £945,000 joint loan from Natwest (ii) He had obtained a standard form trust deed from his solicitors who indicated that

Foreign Tax Liability Self Certification Declaration

Under the CRS, tax authorities require financial institutions such as HSBC to collect and report certain information relating to their customers’ tax statuses.

Foreign Account Tax Compliance Act (FATCA) Out-Law.com

Where are you a tax resident? International affairs

Tax Status Declaration Form Entity

Declaration to confirm Customer tax status under FATCA In relation to chapter 4, subtitle A (sections 1471 through 1474) W-8 form instead of this declaration.

Free Tax Status Declaration Individual Natwest Online PDF

Unexpected request to confirm tax residency Halifax

RBS International Tax Residency

CRS Self-Certication Form for Controlling Persons about an Account Holder’s tax residence status, CRS Self-Certication Form for

Make Up Your Mind!-BLG Banking Law Briefing Tax – UK

Mortgage Application Form intermediary.natwest.com